SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant | ||||||||

| CHECK THE APPROPRIATE BOX: | |||||

| ☐ | Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ☑ | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material under §240.14a-12 | ||||

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | |||||

| ☑ | No fee required | ||||

| ☐ | Fee paid previously with preliminary materials | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||||

Together, we move the world’s supply chains C.H. Robinson brings together customers, carriers, and suppliers to connect supply chains. As the world’s largest and most connected logistics platform, we operate at the heart of global commerce. People get the goods they need through our scale, multimodal solutions, technology, and global teams. With nearly 17,000 supply chain experts in over 35 countries, we are the way supply chains move. | ||||||||||||||||||||

| Mission Our people, processes, and technology improve the world’s transportation and supply chains, delivering exceptional value to our customers and suppliers. | |||||||||||||||||||

| Vision Accelerating commerce through the world’s most powerful supply chain platform. | |||||||||||||||||||

| Our Leading EDGE Values | |||||||||||||||||||

1.Evolve Constantly Challenge the status quo and surface new ideas. 2.Deliver Excellence Encourage big thinking to consistently drive value. | 3.Grow Together Serve and empower our teams to grow and advance. 4.Embrace Integrity Recognize diversity makes us a smarter, stronger team. | |||||||||||||||||||

“C.H. Robinson continues to be uniquely positioned to deliver an unparalleled experience for our customers and carriers and is leveraging an unmatched combination of global scale and services, expertise, data, and technology to drive profitable growth.” Jodee Kozlak,Chair of the Board |  | ||||

| 2023 Proxy Statement | 1 | ||||

| 2 |  | ||||

Advisory Vote on the Compensation ofNamed Executive Officers (“Say-on-Pay”) | ||||||||

PROPOSAL 4 | ||||||||

Ratification of the Selection of Independent Auditors | ||||||||

| 2023 Proxy Statement | 3 | ||||

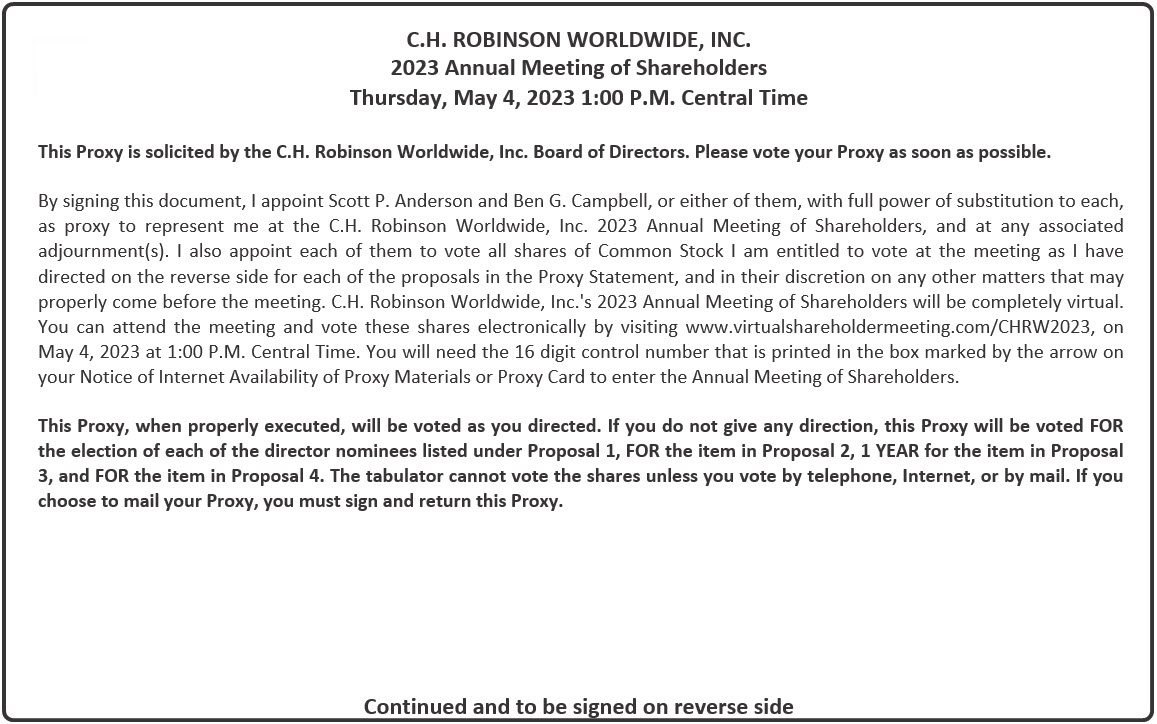

| DATE AND TIME Thursday, May 4, 2023 at 1:00 p.m. (CT) |  | LOCATION www.virtualshareholdermeeting.com/ CHRW2023 |  | WHO CAN VOTE Shareholders of record at the close of business on March 8, 2023 | ||||||||||||

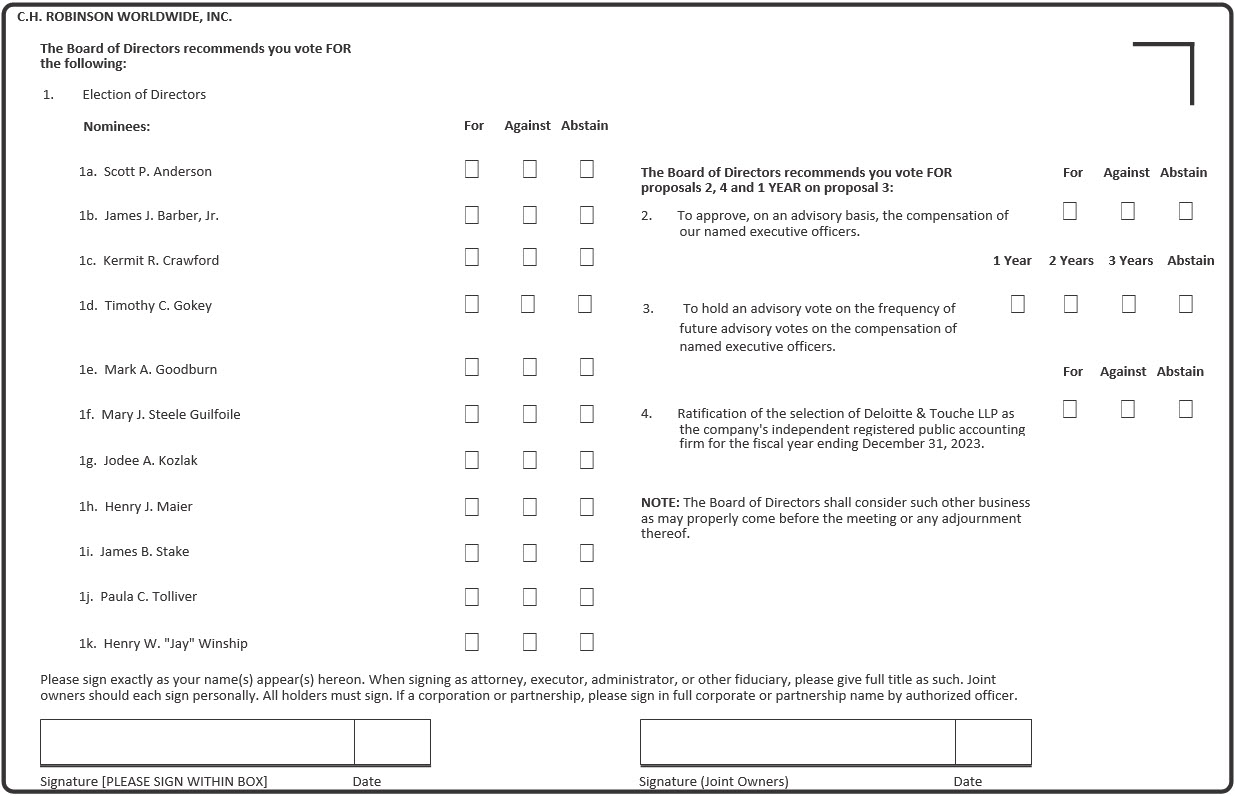

| Proposals | Board Vote Recommendation | For Further Details | ||||||||||||

| 1 | To elect 11 directors to serve for a term of one year |  | FOReach director nominee | Page 12 | ||||||||||

| 2 | To approve, on an advisory basis, the compensation of named executive officers |  | FOR | Page 42 | ||||||||||

| 3 | To hold an advisory vote on the frequency of future advisory votes on the compensation of named executive officers |  | 1 YEAR | Page 78 | ||||||||||

| 4 | To ratify the selection of Deloitte & Touche LLP as the company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 |  | FOR | Page 79 | ||||||||||

| Online www.proxyvote.com |  | By Telephone 1-800-690-6903 |  | By Mail Mark, date, and sign your proxy card and return it by mail in the postage-paid envelope provided to you. | ||||||||||||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 4, 2023.The Proxy Statement and the Annual Report are available at www.proxyvote.com. | ||

| 4 |  | ||||

|  |  |  | ||||||||||||||||||||

$24.7B 2022 Total Revenues | 17,400 Employees Worldwide | 100,000 Active Customers Worldwide | 96,000 Active Carriers and Suppliers | ||||||||||||||||||||

| Increase Share | Profitable Growth | Scale Digitally | Optimize Processes | Spend Strategically | ||||||||||||||||||||||

|  |  |  |  | ||||||||||||||||||||||

| 2023 Proxy Statement | 5 | ||||

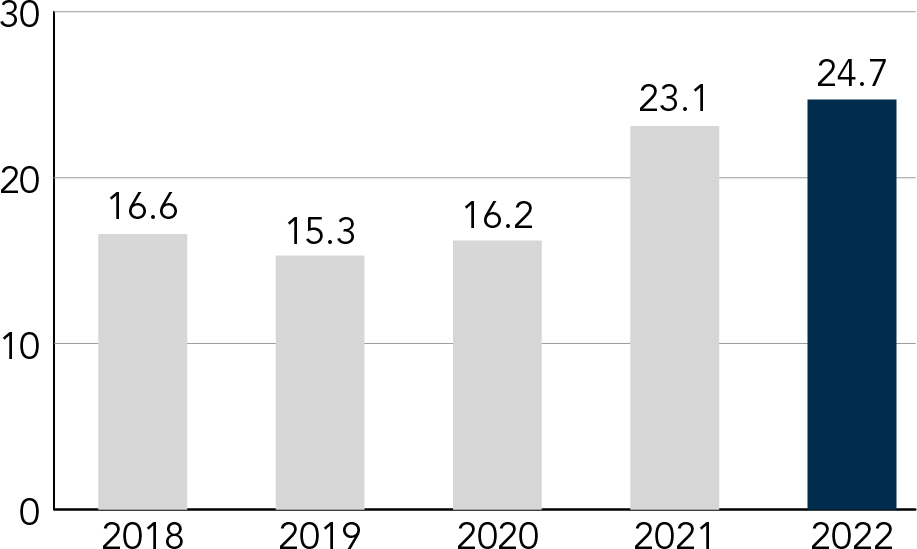

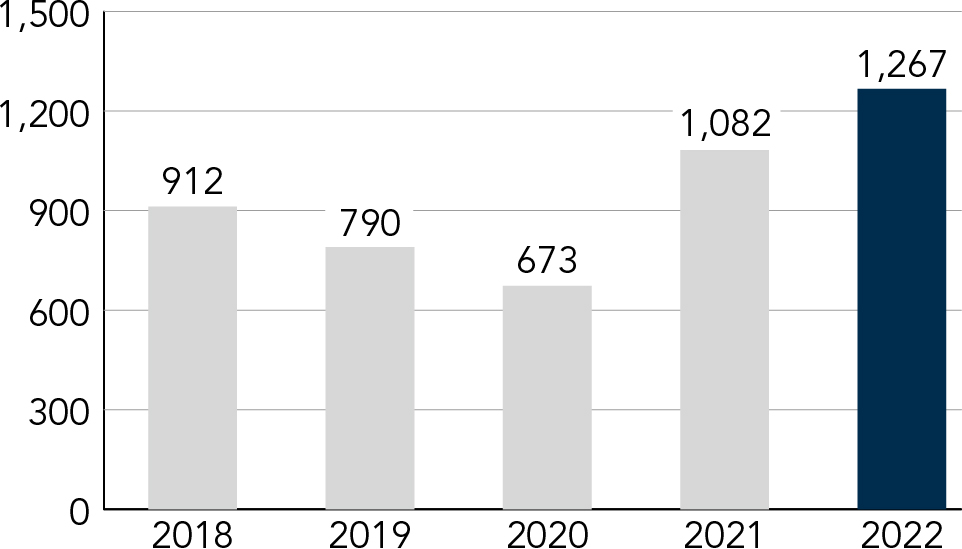

Total Revenues ($) (in billions) [+7% Y/Y] | Adjusted Gross Profits ($)(1) (in billions) [+14% Y/Y] | ||||

|  | ||||

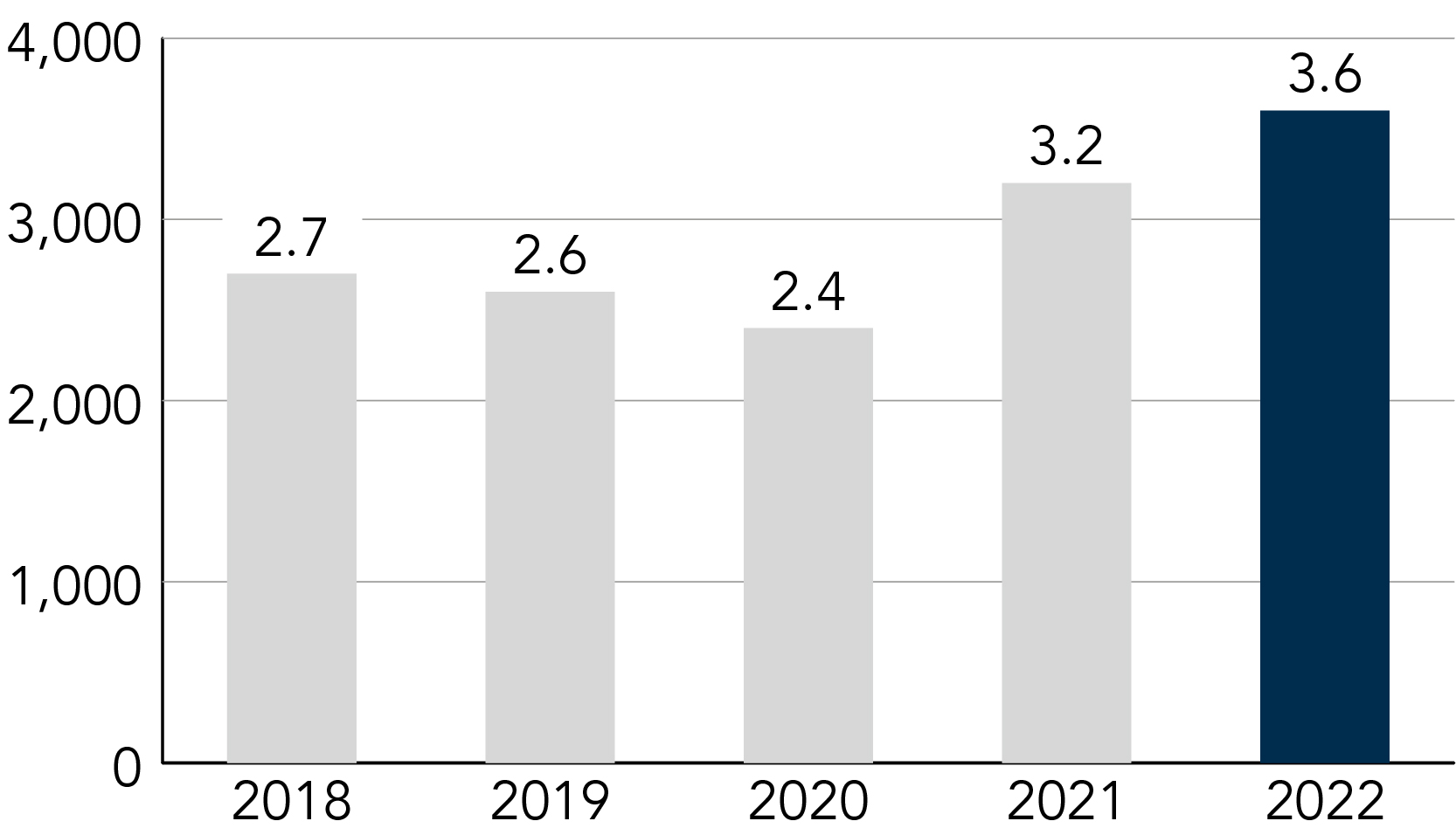

Income from Operations ($) (in millions) [+17% Y/Y] | Diluted Earnings Per Share ($) [+17% Y/Y] | ||||

|  | ||||

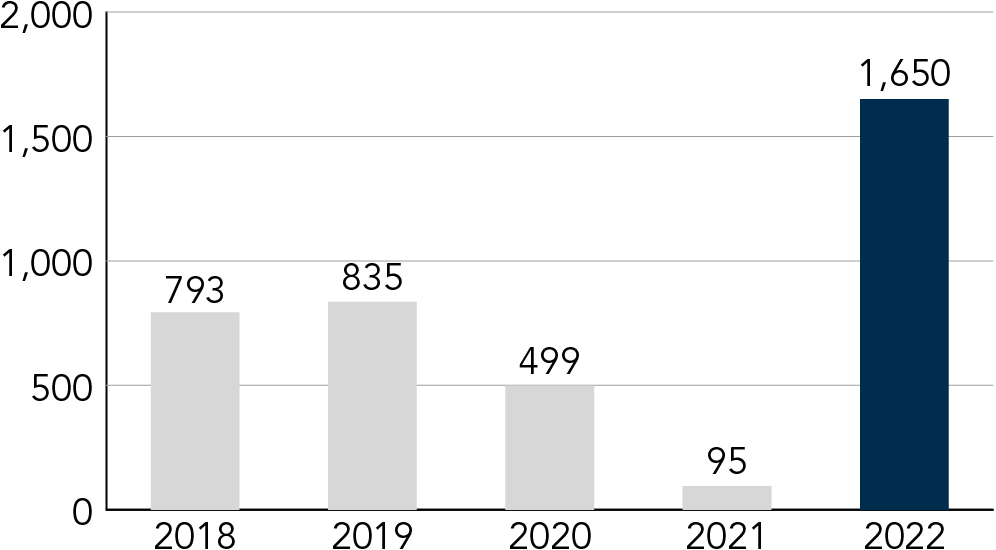

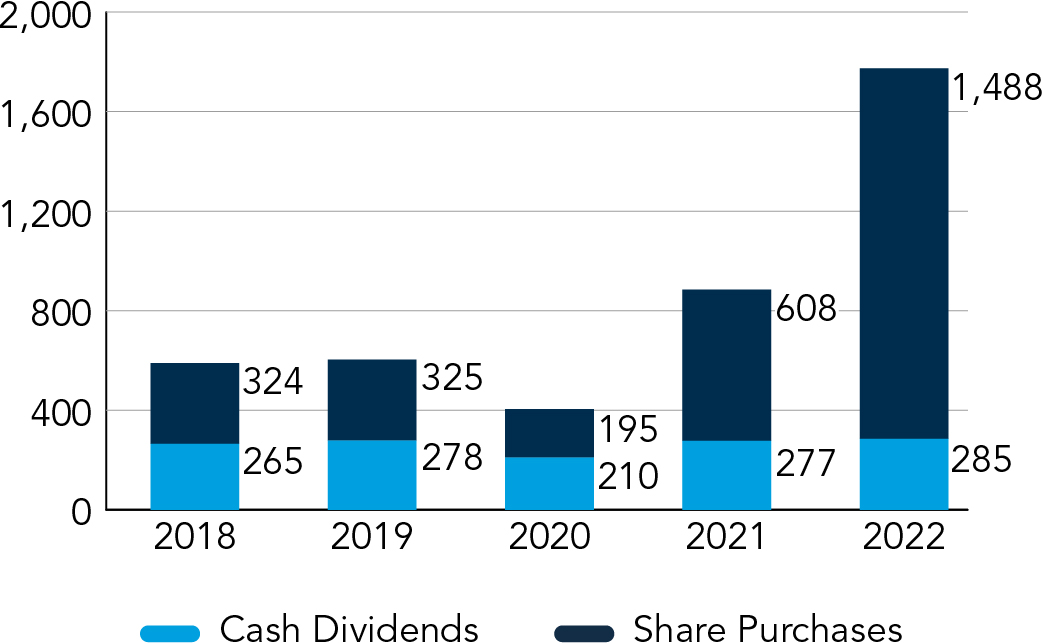

Cash Flow from Operations ($) (in millions) | Capital Distribution ($) (in millions) | ||||

|  | ||||

| 6 |  | ||||

Industry classifications often label us as a transportation company. In reality, C.H. Robinson is unique from traditional asset-owning transportation companies because we deliver a global suite of solutions without an owned fleet. It’s our adaptable model that uniquely positions us to meet the needs of dynamic supply chain environments—excelling in even the most demanding situations. See some of the key areas we are focusing on today. | |||||

| Company Culture | àGoing above and beyond is part of our culture. We deliver exceptional results by building on our fast-paced, service-driven, inclusive culture, where cross-functional collaboration and the pursuit of common goals unites us. As such, we empower our people to do their best work and develop the skill sets and capabilities to win, always guided by our EDGE values (evolve constantly, deliver excellence, grow together, and embrace integrity). These values are brought to life through our Leadership Principles: Adapt and Change; Constantly Innovate and Improve; Deliver Exceptional Results; Compete to Win; Value Differences; Inspire, Coach and Develop our People; and Think Like the Customer. Our Leadership Principles are unique to us and provide a shared understanding of what it means to lead at C.H. Robinson; they reinforce our culture and help drive exceptional results. | ||||

| Talent Strategies | àOur talent strategy enables our organization’s focus on scalability through the right talent that is aligned, incented, and skilled to drive business results. Our strategic priorities for talent include the following: 1. Build a strong and diverse leadership team for now and the future. 2. Leverage workforce planning. 3. Right skill our people for the future. 4. Align incentives to drive outcomes. 5. Build an inclusive workplace that promotes optimal performance. | ||||

| Environmental, Social & Governance | àC.H. Robinson works to create resilient, sustainable supply chains that drive the global economy and make a positive impact on our people, customers, carriers, communities, and planet. àIn spring 2023, we will issue our latest Environmental, Social, and Governance (ESG) Report, and in summer of 2023, we will publish our second annual Task Force on Climate-related Financial Disclosures (TCFD) Report. The TCFD Report is in alignment with the recommendations set forth by the TCFD and is organized by the four TCFD recommendation pillars: Governance, Risk Management, Strategy, and Metrics and Targets. Our ESG Report, which will include disclosures aligned to the Sustainability Accounting Standards Board (SASB), as well as the TCFD will, among other things, outline significant progress on our ESG objectives: •Publicly reporting Scope 1, 2, and 3 emissions •Progress toward science-aligned climate goal •Advances in diversity, equity, and inclusion initiatives •Engagement opportunities for employees, customers, and industry partners on environmental and social topics | ||||

| 2023 Proxy Statement | 7 | ||||

| Who We Engage | |||||||||||||||||||||||

|  |  | |||||||||||||||||||||

| EMPLOYEES | CUSTOMERS | INVESTORS | |||||||||||||||||||||

| Our diverse network connects the world through technology, innovation, and collaboration to enact long-term, sustainable change for global supply chains. | As part of our mission to improve the world’s supply chains, we solve logistics challenges for customers across industries and geographies. | We connect with investors to share company progress and collaborate to understand the topics that they care about most. | |||||||||||||||||||||

|  |  | |||||||||||||||||||||

| CONTRACT CARRIERS & SUPPLIERS | GOVERNMENT & REGULATORS | COMMUNITY | |||||||||||||||||||||

| Through stability, support, and technology, we keep operations moving for the contract carriers, suppliers, and growers integral to supply chains around the world. | Memberships and relationships with industry associations and government agencies keep us connected to existing and proposed rules and regulations. | We support the causes our people are passionate about, contributing to our communities as well as organizations that support our industry and align with our diversity, equity, and inclusion (“DEI”) efforts. | |||||||||||||||||||||

How We Engage with Our Investors We continuously seek to strengthen investor relationships through proactive engagement focused on gaining insight into what matters most to those who choose to invest in our organization. We know their perspectives are critical to our continued success. The long-standing investor outreach program at C.H. Robinson centers around listening and responding to the positions and priorities of our investors through quarterly earnings calls, individual investor calls and meetings, investor conferences, as well as our annual shareholders meeting. | |||||||||||||||||||||||

TOPICS OF ENGAGEMENT àBusiness overview and marketplace dynamics àFinancial performance drivers àStrategic initiatives àCapital allocation strategy àTalent, culture, and DEI àESG priorities and initiatives àAdditional topics from governance and board composition to executive compensation, among many others | WHO IS INVOLVED IN ENGAGEMENT àChair of the Board àChief Executive Officer àChief Financial Officer àChief Operating Officer àDirector of Investor Relations àAdditional members of the C.H. Robinson Executive Team, including our Chief Human Resources & ESG Officer | ||||||||||||||||||||||

| 8 |  | ||||

| PROPOSAL 1 | ||||||||

| Election of Directors | ||||||||

The Board recommends a vote FOReach director nominee. | àSee page 12 | |||||||

Director Since | Committee Membership | |||||||||||||||||||||||||

| Director Name | Independent | Age | AC | TCC | GC | CAPC | ||||||||||||||||||||

| Scott P. Anderson Interim Chief Executive Officer; Former CEO of Patterson Companies | 56 | 2012 |  | ||||||||||||||||||||||

| James J. Barber, Jr. Retired Chief Operating Officer, United Parcel Service |  | 62 | 2022 |  | |||||||||||||||||||||

| Kermit R. Crawford Retired President and Chief Operating Officer, Rite Aid |  | 63 | 2020 |  |  | ||||||||||||||||||||

| Timothy C. Gokey Chief Executive Officer, Broadridge Financial Solutions |  | 61 | 2017 |  |  | ||||||||||||||||||||

| Mark A. Goodburn Retired Chairman and Global Head of Advisory, KPMG International |  | 60 | 2022 |  |  | ||||||||||||||||||||

| Mary J. Steele Guilfoile Former Executive Vice President, JP Morgan Chase |  | 68 | 2012 |  |  | ||||||||||||||||||||

| Jodee A. Kozlak Chair of the Board; Former Executive Vice President and Chief Human Resources Officer, Target Corporation |  | 59 | 2013 |  |  | ||||||||||||||||||||

| Henry J. Maier Retired President and Chief Executive Officer of FedEx Ground |  | 69 | 2022 |  |  | ||||||||||||||||||||

| James B. Stake Retired Executive Vice President, 3M |  | 70 | 2009 |  | |||||||||||||||||||||

| Paula C. Tolliver Retired Corporate Vice President and Chief Information Officer, Intel |  | 58 | 2018 |  |  | ||||||||||||||||||||

| Henry W. “Jay” Winship Founder, President and Managing Member of Pacific Point Capital |  | 55 | 2022 |  |  | ||||||||||||||||||||

AC- Audit Committee GC- Governance Committee | TCC- Talent & Compensation Committee CAPC- Capital Allocation and Planning Committee |  | Chair |  | Member | ||||||||||||

| 2023 Proxy Statement | 9 | ||||

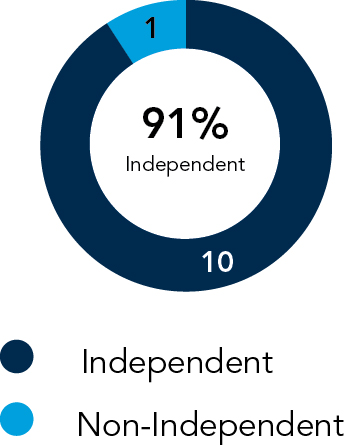

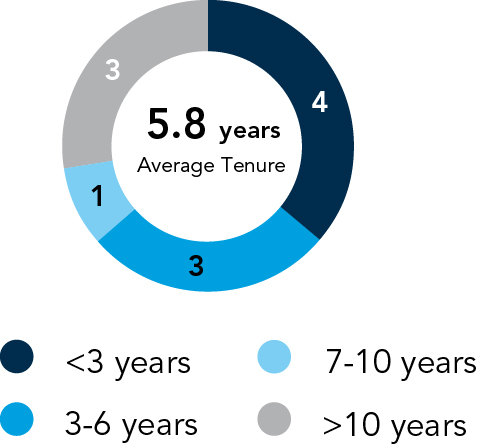

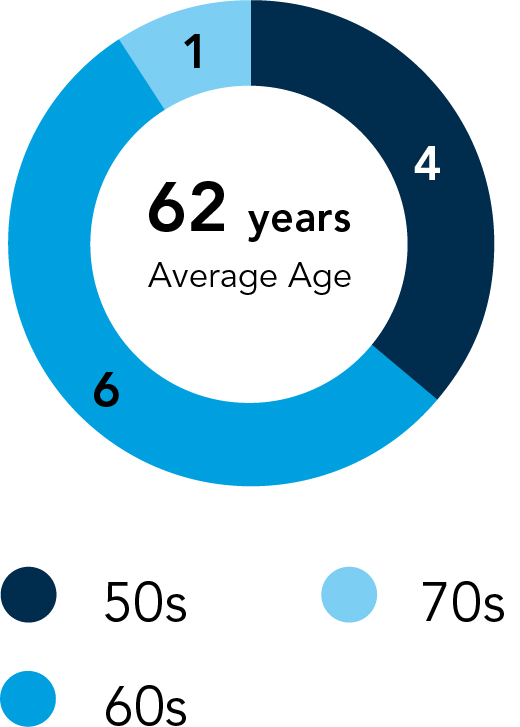

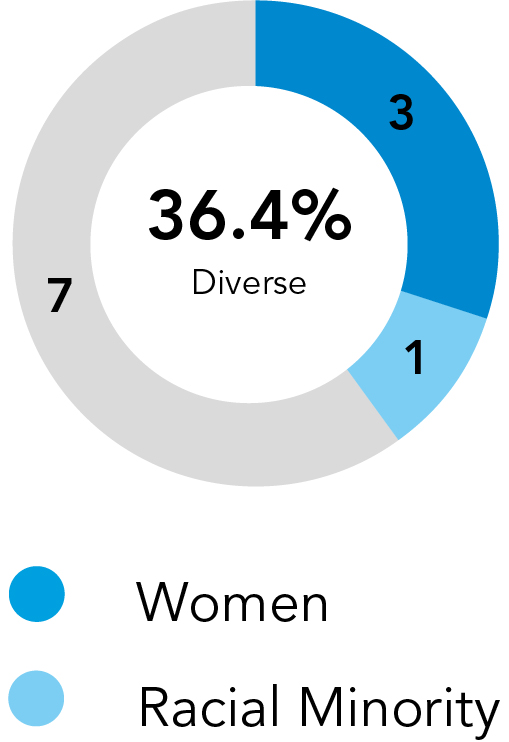

| Independence | Tenure | Age | Diversity | ||||||||

|  |  |  | ||||||||

| PROPOSAL 2 | ||||||||

| Advisory Vote on the Compensation of Named Executive Officers | ||||||||

The Board recommends a vote FORthis proposal | ||||||||

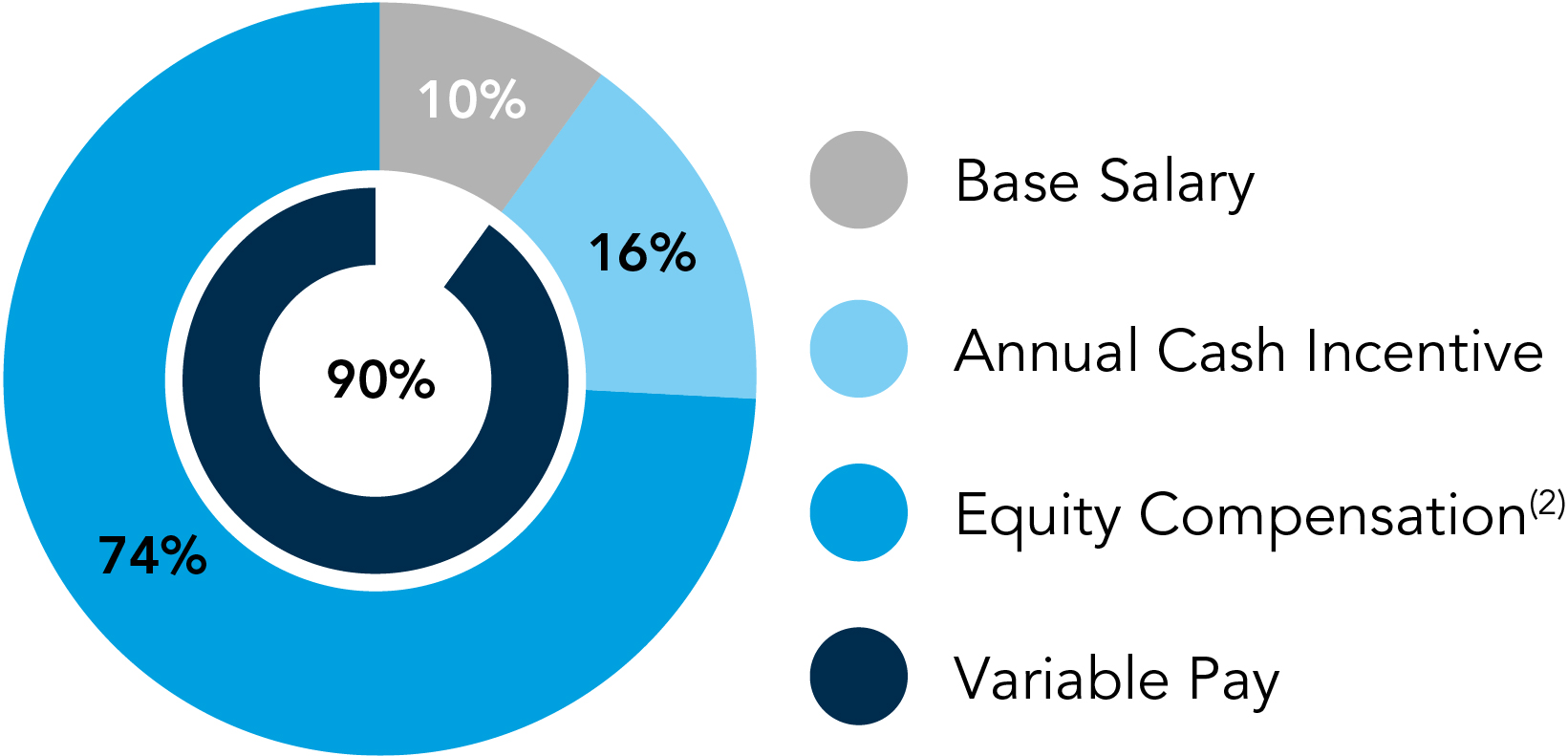

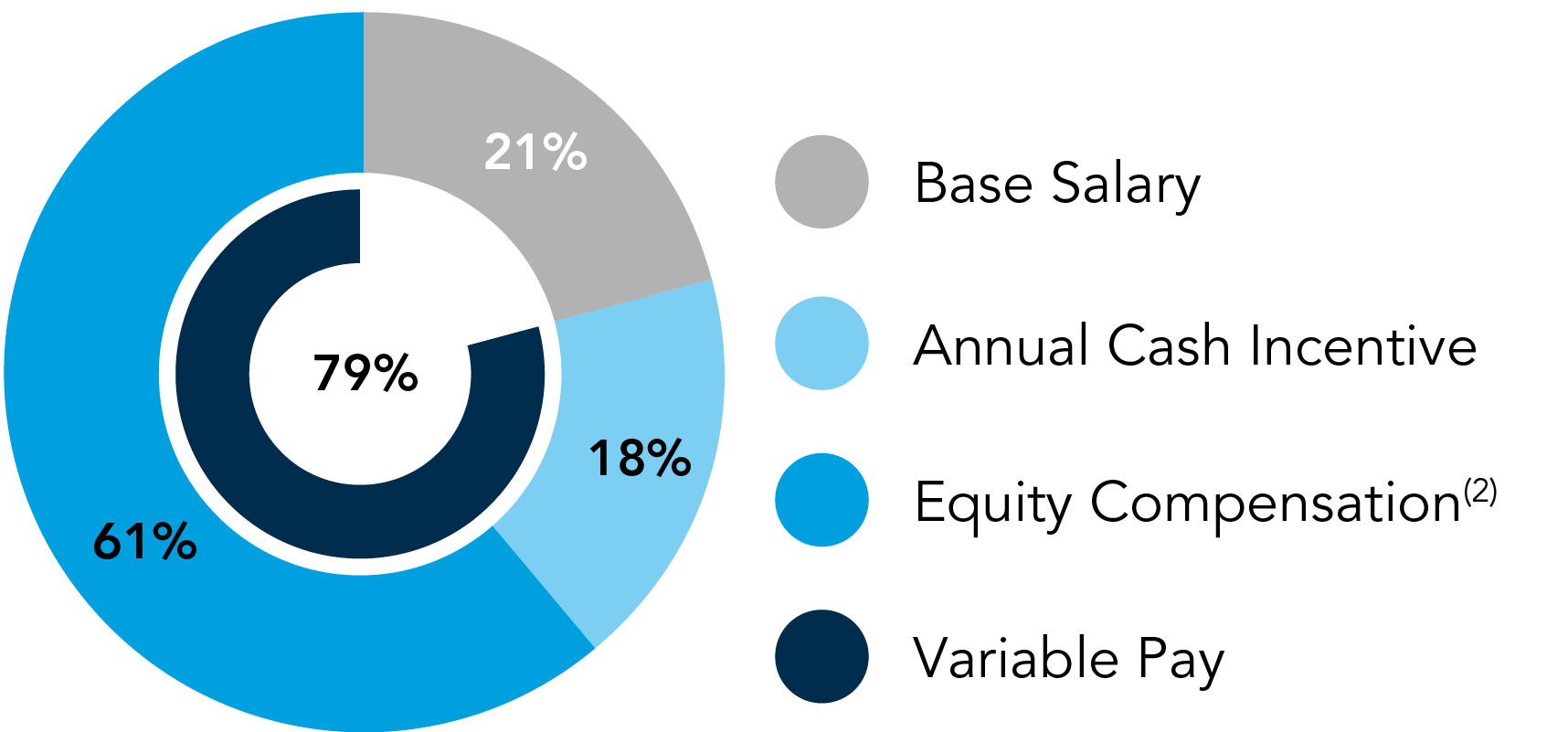

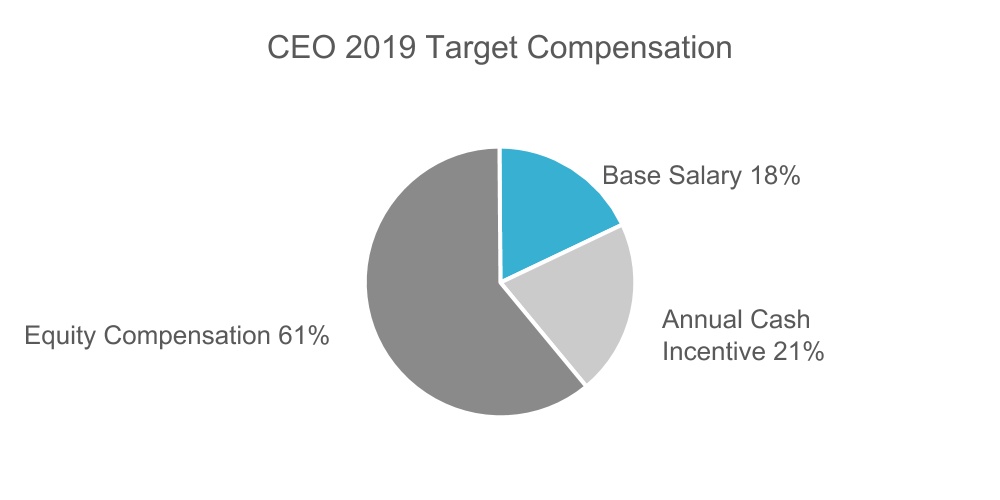

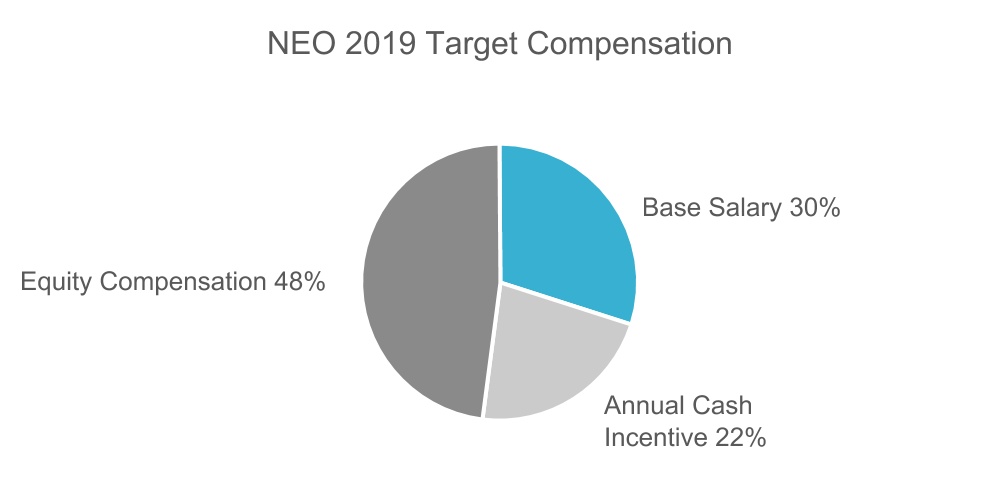

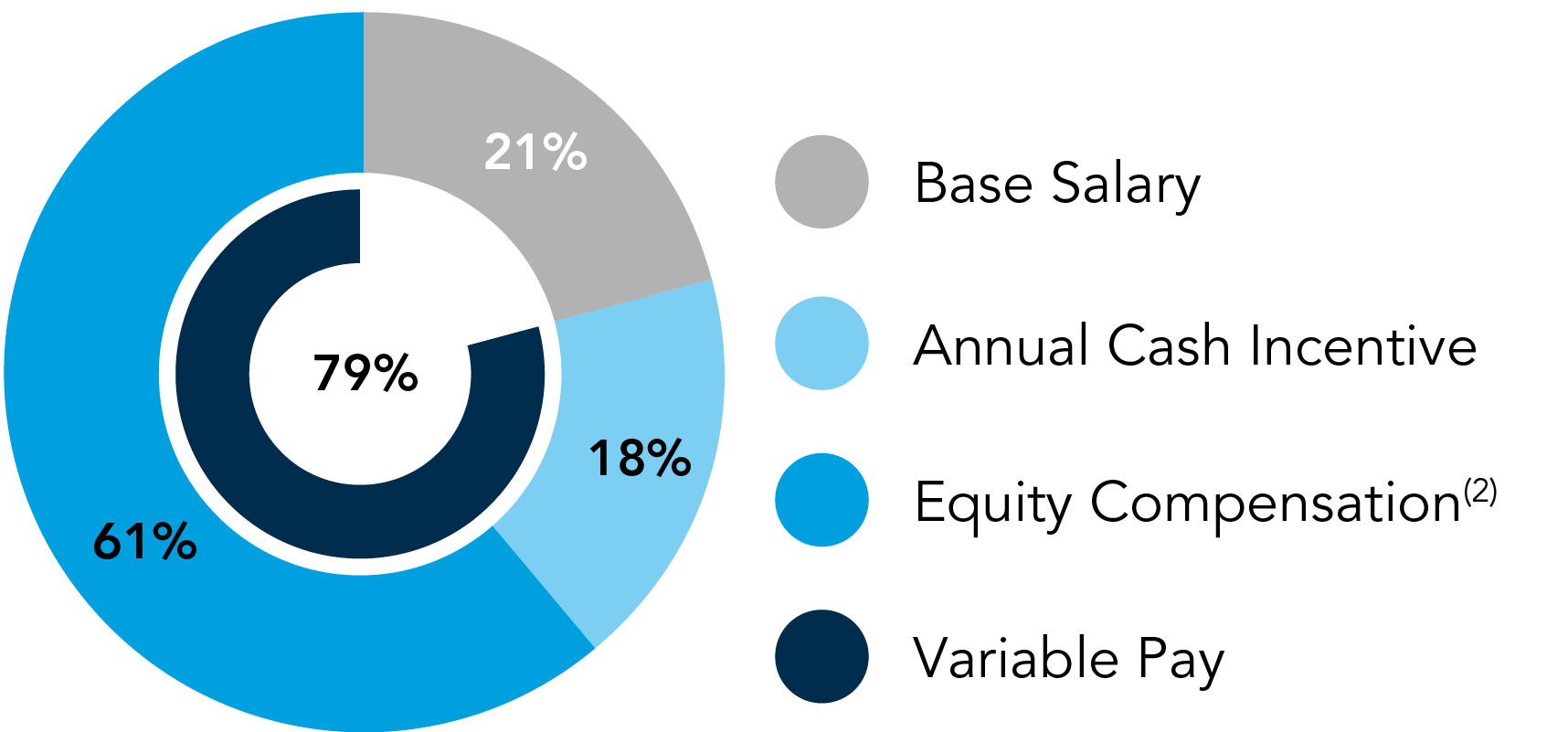

CEO 2022 Target Compensation(1) | Average Other NEO 2022 Target Compensation | ||||

|  | ||||

| 10 |  | ||||

| Advisory Vote on the Frequency of Future Advisory Votes on the Compensation of Named Executive Officers | ||||||||

The Board recommends a vote for 1 YEARas the frequency for which shareholders shall have future advisory votes on the compensation of named executive officers | ||||||||

| PROPOSAL 4 | ||||||||

| Ratification of the Selection of Independent Auditors | ||||||||

The Board recommends a vote FORthis proposal | àSee page 79 | |||||||

| 2023 Proxy Statement | 11 | ||||

Background There are 11 nominees for election to the C.H. Robinson Board of Directors (the “Board of Directors” or the “Board”) for a one-year term. All 11 of the nominees are current directors. The Board of Directors has set the number of directors constituting the Board of Directors effective at the Annual Meeting at 11. Scott P. Anderson, James J. Barber, Jr., Kermit R. Crawford, Timothy C. Gokey, Mary J. Steele Guilfoile, Jodee A. Kozlak, Henry J. Maier, James B. Stake, Paula C. Tolliver, and Henry W. “Jay” Winship are directors whose terms expire at the Annual Meeting. Mr. Barber is standing for election by shareholders for the first time at the Annual Meeting. Mr. Barber was identified as a potential candidate for election to the Board of Directors by multiple sources, including non-employee directors and shareholders. The Board of Directors has determined that all the directors and nominees, except for Mr. Anderson, are independent under the current standards for “independence” established by the Nasdaq Stock Market, on which the C.H. Robinson stock is listed under the symbol “CHRW”. In connection with its evaluation of director independence, the Board of Directors considered the following transactions, each of which were entered into in the ordinary course of business: For Mr. Gokey, services provided in the ordinary course of business on behalf of the company by Broadridge Financial Solutions where Mr. Gokey is employed, and for which payments were less than 1% of either companies’ revenues or operations in the last three fiscal years. For Mr. Goodburn, services provided in the ordinary course of business on behalf of the company by KPMG LLP where Mr. Goodburn was employed until 2020, and for which payments were less than 1% of either companies’ revenues or operations in the last three fiscal years. Mr. Goodburn currently serves KPMG as a consultant in an advisory role. The Board considered these relationships and their significance in determining that these directors are independent. Information concerning each nominee is provided below. Messrs. Maier and Winship were each selected as a director pursuant to the cooperation agreements with the Ancora Group in 2022 and 2023. Based on their service on the Board of Directors over the last year, the Governance Committee and the Board believe they are qualified nominees who are committed to promoting the long-term interests of our shareholders. As required by the cooperation agreement in effect at the time, the Ancora Group consented to increasing the size of the Board to accommodate the election of Mr. Barber. On the recommendation of our Governance Committee, the Board of Directors has nominated Anderson, Barber, Crawford, Gokey, Goodburn, Guilfoile, Kozlak, Maier, Stake, Tolliver, and Winship for election to the Board of Directors at the Annual Meeting for terms of one year each. Each has indicated a willingness to serve. Mr. Anderson and Ben G. Campbell will vote the proxies received by them for the election of director nominees Anderson, Barber, Crawford, Gokey, Goodburn, Guilfoile, Kozlak, Maier, Stake, Tolliver, and Winship unless otherwise directed. If any nominee becomes unavailable for election at the Annual Meeting, Messrs. Anderson and Campbell may vote for a substitute nominee at their discretion as recommended by the Board of Directors, subject to the terms of the cooperation agreement with the Ancora Group described on page 25. | ||||||||

BOARD VOTING RECOMMENDATION The Board of Directors recommends a vote FOR the election of Scott P. Anderson, James J. Barber, Jr., Kermit R. Crawford, Timothy C. Gokey, Mark A. Goodburn, Mary J. Steele Guilfoile, Jodee A. Kozlak, Henry J. Maier, James B. Stake, Paula C. Tolliver, and Henry W. “Jay” Winship as directors of C.H. Robinson Worldwide, Inc. | ||||||||

| ||||||||

| Female | Male | |||||||

| Board Diversity Matrix (As of March 21, 2023) | ||||||||

| Total Number of Directors | 11 | |||||||

| Part I: Gender Identity | ||||||||

| Directors | 3 | 8 | ||||||

| Part II: Demographic Background | ||||||||

| African American or Black | 0 | 1 | ||||||

| White | 3 | 7 | ||||||

| 13 | ||||||||||

| Scott P. Anderson | |||||

| |||||||||||

Director Qualifications Mr. Anderson has significant public company senior management and executive experience through his service in several senior leadership positions at Patterson Companies. He also has public company board experience, having served as a member of Patterson’s board of directors from 2010 to | |||||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Interim Chief Executive Officer (2023 – Present) •Chairman of the Board (2020 – 2022) •Lead Independent Director (2019 – 2020) •Director (2012 – Present) àPatterson Companies, Inc. (Nasdaq: PDCO),a provider of animal and dental health products and services •Senior Advisor (2017 – 2019) •President and Chief Executive Officer (2010 – 2017) •Chairman of the Board (2013 – 2017) •Director (2010 – 2017) •President of Patterson Dental Supply, Inc. (2006 – 2010) •Held senior management positions in the dental unit, including vice president, sales and vice president, marketing àOther Experience •Senior Advisor, TPG Capital Healthcare •Executive Council Head, Carlson Private Capital Partners •Trustee and Former Chairman of the Board, Gustavus Adolphus College •Former Director, Ordway Theater •Former Chairman, Dental Trade Alliance Public Board Experience àDuke Realty Corporation (NYSE: DRE) •Former Director and member of the Audit Committee (2022) Education àMaster of Business Administration, Northwestern University, Kellogg School of Management àBachelor of Arts, Gustavus Adolphus College | |||||||||||

NON-INDEPENDENT (Director Nominee) Age: 56 Director Since: January 2012 Committees: àCapital Allocation and Planning | |||||||||||

| 14 |  | ||||

| James J. Barber, Jr. | |||||

| ||||||||

Director Qualifications Mr. | ||||||||

INDEPENDENT (Director Nominee) Age: 62 Director Since: December 2022 Committees: àAudit | ||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àUnited Parcel Service, Inc. (“UPS”) (NYSE: UPS), a package delivery company and leading provider of global supply chain management solutions •Chief Operating Officer (2018 – 2020) •President of UPS International (2013 – 2018) •President UPS Europe (2011 – 2013) •Other roles of increasing responsibility, including Region and District Manager, Mergers & Acquisition Transaction Manager, Region and District Controller, Accounting Manager and various other management positions in Finance & Accounting •Began career at UPS as a package delivery driver in 1985 àOther Experience •Former Trustee, The UPS Foundation •Former Board member, UNICEF •Former Board member, Folks Center for International Business at the University of South Carolina Public Board Experience àUS Foods, Inc. (NYSE: USFD) •Director and member of the Compensation and Human Capital Committee (2022 – Present) Education àBachelor of Science in Finance, Auburn University | ||||||||

| ||||||||

Mr. Crawford has significant executive and leadership experience based on his senior roles with Rite Aid Corporation and Walgreens. He has also developed expertise in the areas of strategic investment and digital transformation. Mr. Crawford has relevant public company board experience through his membership on the boards of Visa and The Allstate Corporation, as well as his prior board experience at TransUnion and LifePoint Health. | ||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2020 – Present) àRite Aid Corporation (NYSE: RAD), a retail drugstore chain •President and Chief Operating Officer (2017 – 2019) àSycamore Partners, a private equity firm specializing in consumer, distribution, and retail-related investments •Operating Partner and Advisor (2015 – 2017) àWalgreen Company, one of the largest drugstore chains in the United States (“Walgreens”) •Executive Vice President and President of Pharmacy, Health, and Wellness (2011 – 2014) •Multiple roles of increasing responsibility (1983 – 2011), including as Executive Vice President and President of Pharmacy Services àOther Experience •Director, Northwestern Medicine North/Northwest Region •Trustee, The Field Museum Chicago Public Board Experience àThe Allstate Corporation (NYSE: ALL) •Director and Chairman of the Audit Committee (2013 – Present) àVisa Inc. (NYSE: V) •Director and member of the Audit & Risk Committee and Nominating & Corporate Governance Committee (2022 – Present) àTransUnion (NYSE: TRU) •Director, member of the Audit and Compliance Committee and Technology, Privacy and Cybersecurity Committee (2019 – 2021) àLifePoint Health (NYSE: LPNT; no longer publicly traded) •Director and member of the Audit and Compliance Committee, Compensation Committee, Corporate Governance & Nominating Committee, and Quality Committee (2016-2018) Education àBachelor of Science, The College of Pharmacy and Health Sciences at Texas Southern University | ||||||||

INDEPENDENT (Director Nominee) Age: 63 Director Since: September 2020 Committees: àGovernance (Chair) àTalent & Compensation | ||||||||

| 16 |  | ||||

| Timothy C. Gokey | |||||

| ||||||||

Director Qualifications Through his service in a | ||||||||

INDEPENDENT (Director Nominee) Age: 61 Director Since: October 2017 Committees: àAudit àTalent & Compensation | ||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2017 – Present) àBroadridge Financial Solutions (NYSE: BR), a public corporate services and financial technology company •Chief Executive Officer (2019 – Present) •Director (2019 – Present) •President (2017 – 2020) •Senior Vice President and Chief Operating Officer (2012 – 2019) •Chief Corporate Development Officer (2010 – 2012) àH&R Block, a tax preparation company •President, Retail Tax (2004 – 2009) àMcKinsey & Company, a business strategy consulting company •Partner (1986 – 2004) àOther Experience •Director, Partnership for New York City Public Board Experience àNone Education àDoctorate in Finance; Bachelor of Arts/Master of Arts in Philosophy, Politics, and Economics, University of Oxford as a Rhodes Scholar àBachelor of Arts in Public Affairs and Management Engineering, Princeton University | ||||||||

| 2023 Proxy Statement | 17 | ||||

| Mark A. Goodburn | |||||

| ||||||||

Director Qualifications Mr. Goodburn has significant executive and leadership experience based on his senior leadership roles with KPMG. Specifically, Mr. Goodburn has deep experience and expertise in the areas of strategy, finance, mergers and acquisitions, and global management and operations. Mr. Goodburn meets the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. | ||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àKPMG International, a multinational professional services network •Senior Advisor to KPMG LLP (2021 – Present) •Global Head of Strategic Investments and Innovation (2018 – 2021) •Chairman and Global Head of Advisory (2011 – 2020) •Vice Chairman of KPMG LLP and Americas Head of Advisory and Strategic Investments (2005 – 2011) •Various roles, including as Managing Partner-Silicon Valley Office, Member of KPMG US and Americas Board of Directors and Global Head of KPMG’s Technology, Media and Telecommunications (1997 – 2005) •Roles of increasing responsibility at KPMG LLP (1984 – 1997) àOther Experience •Presidents National Advisory Council member, Minnesota State University •Executive Board member, Cox School of Business Executive Board, Southern Methodist University Public Board Experience àNone Education àBachelor of Science in Business, Minnesota State University, Mankato àCertified Public Accountant | ||||||||

INDEPENDENT (Director Nominee) Age: 60 Director Since: May 2022 Committees: àAudit àCapital Allocation & Planning | ||||||||

| 18 |  | ||||

| Mary J. Steele Guilfoile | |||||

| ||||||||

Director Qualifications Ms. Guilfoile has significant experience and expertise in the areas of corporate mergers and acquisitions, business integration, and financing through her association with the investment banks of several large financial institutions. She also has public board experience through her membership on the boards of, among others, Interpublic, | ||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2012 – Present) àMG Advisors, Inc.,a privately-owned financial services merger and acquisition advisory and consulting services firm •Chair (2002 – Present) àThe Beacon Group, LP,a private equity investment partnership •Partner (1998 – Present) àJP Morgan Chase (and its predecessor companies, Chase Manhattan Corporation and Chemical Banking Corporation), a multinational bank •Executive Vice President, Corporate Treasurer (2000 – 2002) •Various leadership roles (1986 - 1996), including as Chief Administrative Officer and Strategic Planning Officer for its investment bank, as well as various merger integration, executive management and strategic planning positions àOther Experience •Former Partner, CFO and COO, The Beacon Group, LLC •Consultant, Booz Allen Hamilton •Manager in Audit Services, Coopers & Lybrand (now part of PwC) Public Board Experience àThe Interpublic Group of Companies (NYSE: IPG) •Director, Chair of the Audit Committee and member of the Corporate Governance and Social Responsibility Committee (2007 – Present) àPitney Bowes Inc. (NYSE: PBI) •Director and member of the Finance Committee and Audit Committee (2018 – Present) àDufry AG (publicly traded on the SIX Swiss Exchange) •Director and Chair of the Audit Committee (2020 – Present) Education àMaster of Business Administration, Columbia University Graduate School of Business àBachelor of Science in Accounting, Boston College àCertified Public Accountant | ||||||||

INDEPENDENT (Director Nominee) Age: 68 Director Since: October 2012 Committees: àGovernance àTalent & Compensation | ||||||||

| 2023 Proxy Statement | 19 | ||||

| Jodee A. Kozlak | |||||

| ||||||||

| Through her human resources executive leadership at Target and Alibaba Group and extensive public board experience, Ms. Kozlak has developed significant knowledge and expertise in human capital strategy, global operations, and digital transformation. Her experience has also given her a deep understanding of executive compensation within a public company. | |||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Chair of the Board (January 2023 – Present) •Director (2013 – Present) àKozlak Capital Partners, LLC •Founder and CEO (2017 – Present) àAlibaba Group (NYSE: BABA), a multinational conglomerate specializing in e-commerce, retail, Internet, and technology •Global Senior Vice President of Human Resources (2016 – 2017) àTarget Corporation (NYSE: TGT), one of the largest U.S. retailers •Executive Vice President and Chief Human Resources Officer (2006 – 2016) •Senior Vice President, Human Resources (2004 – 2006) •General Counsel, Owned Brand Sourcing and Labor & Employment (2001 – 2004) àOther Experience •Former Partner in the litigation practice, Greene Espel, PLLP •Former Senior Auditor, Arthur Andersen & Co •Past fellow, Distinguished Careers Institute (DCI) at Stanford University Public Board Experience àK.B. Home (NYSE: KBH) •Director and member of the Compensation Committee (2021 – Present) àMGIC Investment Corp. (NYSE: MTG) •Director, Chair of the Business Transformation and Technology Committee and member of the Management Development, Nominating and Governance Committee (2018 – Present) àLeslie’s, Inc. (Nasdaq: LESL) •Director, Chair of the Nominating and Corporate Governance Committee and member of the Compensation Committee (2020 – March 2023) Education àJuris Doctor, University of Minnesota àBachelor of Arts in Accounting, College of St. Thomas | |||||||||

INDEPENDENT (Director Nominee) Age: 59 Director Since: February 2013 Committees: àTalent & Compensation (Chair) àGovernance | |||||||||

| 20 |  | ||||

| Henry J. Maier | |||||

| ||||||||

Throughout his career at FedEx and 40 years of experience in the transportation industry, Mr. Maier gained significant experience and expertise in the areas of capital markets, corporate governance, and logistics. Mr. Maier also has relevant public company board experience through his membership on the boards of CalAmp Corporation, Carparts.com, Inc., and Kansas City Southern (formerly a publicly traded company). | ||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àFedEx Corp. (NYSE: FDX), multinational conglomerate holding company focused on transportation, e-commerce and business services •President and Chief Executive Officer of FedEx Ground (2013 – 2021) •Executive Vice President, Strategic Planning and Communication of FedEx Ground (2009 – 2013) •Senior Vice President, Strategic Planning and Communications (2006 – 2009) •Various other roles, including as a member of the Strategic Management Committee and leadership positions in logistics, sales, marketing and communications Public Board Experience àCalAmp Corp. (Nasdaq: CAMP) •Independent Chair of the Board, member of the Governance and Nominating Committee and Human Capital Committee (2021 – Present) àCarParts.com, Inc. (Nasdaq: PRTS) •Director and member of the Nominating and Corporate Governance Committee (2021 – Present) àKansas City Southern (NYSE: KSU; no longer publicly traded) •Director, Chair of the Compensation & Organization Committee, member of the Finance & Strategic Investment Committee (2017 – Present) Education àBachelor of Arts in Economics, University of Michigan | ||||||||

INDEPENDENT (Director Nominee) Age: 69 Director Since: February 2022 Committees: àGovernance àCapital Allocation and Planning | ||||||||

| 2023 Proxy Statement | 21 | ||||

| James B. Stake | |||||

| ||||||||

Director Qualifications Throughout his career at 3M Company, Mr. Stake gained extensive public company senior management experience at a large company that operates worldwide. In particular, Mr. Stake’s foreign leadership positions and his position with 3M’s Enterprise Services, provide valuable perspective for C.H. | ||||||||

INDEPENDENT (Director Nominee) Age: 70 Director Since: January 2009 Committees: àAudit (Chair) | ||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2009 – Present) à3M Company (NYSE: MMM), multinational conglomerate operating in the fields of industrial, consumer, healthcare, electronics, and worker safety •Executive Vice President of 3M’s Enterprise Services (2006 – 2008) •Various positions of increasing responsibility leading global health care, industrial, and commercial businesses during his more than 30 years with 3M Company •Over 12 years of foreign assignments in Europe and South America àAtiva Medical Corp. •Chairman of the Board (2008 – 2020) àOther Experience •Adjunct Professor, University of Minnesota’s Carlson School of Management •Board of Trustees, Twin Cities Public Television Public Board Experience àOtter Tail Corporation (Nasdaq: OTTR) •Director, Chair of the Compensation and Human Capital Committee and member of the Audit Committee (2008 – retirement announced for April 2023) Education àMaster of Business Administration, Wharton School, University of Pennsylvania àBachelor of Science in Chemical Engineering, Purdue University | ||||||||

| 22 |  | ||||

| Paula C. Tolliver | |||||

| ||||||||

Director Qualifications Ms. Tolliver has | ||||||||

INDEPENDENT (Director Nominee) Age: 58 Director Since: October 2018 Committees: àAudit àCapital Allocation & Planning | Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2018 – Present) àTech Edge, LLC, a technology consulting firm •Founder and Principal (2020 – Present) àIntel Corporation (Nasdaq: INTC), a multinational technology company •Corporate Vice President and Chief Information Officer (2016 – 2019) àThe Dow Chemical Company (a wholly owned subsidiary of Dow, Inc.) (NYSE: DOW), a global materials science leader in packaging, infrastructure, and consumer care •Corporate Vice President of Business Services and Chief Information Officer (2012 – 2016) •Vice President, Procurement (2006 – 2011) •Chief Information Officer and Chief Digital Officer of Dow AgroScience (2000 – 2006) •Various other roles of increasing responsibility in Information Technology including as Europe Information Services Director (1996 – 2000) àSyniti, a pioneering data software and services company •Director and member of the Technology Committee (2020 – Present) Public Board Experience àInvesco (NYSE: IVZ) •Director and member of the Nomination and Corporate Governance Committee, Compensation Committee and Audit Committee (2021 – Present) Education àBachelor of Science in Business Information Systems and Computer Science, Ohio University | |||||||

| 2023 Proxy Statement | |||||

| 23 | |||||

| ||||||||

Director Qualifications Mr. Winship has significant experience and expertise in the areas of capital allocation, mergers and acquisitions, corporate governance, and logistics. He is an active portfolio manager, which provides our Board with valuable insights from an institutional investor perspective. Mr. Winship also has public board experience through his membership on the board of Bunge Limited, and his prior membership on the boards of CoreLogic, Inc. and Esterline Technologies Corporation. | |||||||||||||||

Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àPacific Point Companies,a privately owned asset management firm •Founder, President and Managing Member of Pacific Point Capital LLC (2016 – Present) •Founder and Managing Member of Pacific Point Advisor, LLC (2016 – Present) àRelational Investors LLC, an activist investment fund •Principal, Senior Managing Director and Investment Committee member (1996 – 2015) Other Experience •Advisor, Corporate Governance Institute at San Diego State University Fowler College of Business Public Board Experience àBunge Limited (NYSE: BG) •Director, Chair of the Audit Committee and member of the Corporate Governance and Nominations Committee and Human Resources and Compensation Committee (2018 – Present) àCoreLogic, Inc. (NYSE: CLGX; no longer publicly traded) •Former Director àEsterline Technologies Corporation (NYSE: ESL; no longer publicly traded) •Former Director Education àMaster of Business Administration, University of California, Los Angeles àBachelor of Business Administration in Finance, University of Arizona àCertified Public Accountant àChartered Financial Analyst | |||||||||||||||

INDEPENDENT (Director Nominee) Age: 55 Director Since: February 2022 Committees: àTalent & Compensation àCapital Allocation and Planning (Chair) | |||||||||||||||

| ||||||||

| ||||||||

|  | |||||||||||||||||||

| The Governance Committee initially evaluates a prospective nominee based on his or her resume and other background information that has been provided to the committee. | For further review, a member of the Governance Committee will contact those candidates whom the Governance Committee believes are qualified, may fulfill a specific need of the Board of Directors, and would otherwise best contribute to the Board of Directors. | Based on the information the Governance Committee learns during this process, it determines which nominee(s) to recommend to the Board of Directors to submit for election. | ||||||||||||||||||

| ||||||||

| 26 |  | ||||

| 2023 Proxy Statement | 27 | ||||

| Active, Independent Board | •10 of 11 directors are independent •Executive sessions of independent directors held at each regularly scheduled meeting •Independent Board Chair •Independent Audit Committee, Governance Committee, and Talent & Compensation Committee •High rate of attendance at Board and committee meetings •Complete access to management •Access to outside advisors at the company’s expense | ||||

| Robust Corporate Governance | •Board review of company strategy on at least an annual basis •Active Board involvement in management succession planning •Robust Board oversight on ESG matters •Comprehensive and strategic approach to enterprise risk management •Declassified Board •Majority vote standard in uncontested elections •Commitment to Board refreshment with four new Board members added in 2022 with a diverse set of skills and experience | ||||

| Shareholder Rights | •Proxy access right •No poison pill •Proactive investor outreach program; see "Stakeholder Engagement” on page 8 •Annual election of all directors •Plurality vote standard in contested elections •Annual “say-on-pay” vote | ||||

| Board and Management Checks and Balances | •Prohibition on pledging and hedging •Stock ownership guidelines for directors and management •Annual Board and Committee self-evaluation •Clawback policy | ||||

| 28 |  | ||||

| Engaged and Active Board of Directors | |||||||||||||||||||||||

| 14 |  |  |  | ||||||||||||||||||||

| Board of Director meetings in 2022 | All directors attended at least 75% of 2022 Board and committee meetings | 100% Director nominee attendance at the 2022 Annual Meeting | Each 2022 regularly scheduled Board meeting also included a non-management director executive session | ||||||||||||||||||||

| 2023 Proxy Statement | 29 | ||||

| Directors | Audit | Talent & Compensation | Governance | Capital Allocation and Planning | ||||||||||

| Scott P. Anderson |  | |||||||||||||

James J. Barber, Jr.(1) |  | |||||||||||||

Kermit R. Crawford(1) |  |  | ||||||||||||

Timothy C. Gokey(1) |  |  | ||||||||||||

Mark A. Goodburn(1) |  |  | ||||||||||||

Mary J. Steele Guilfoile(1) |  |  | ||||||||||||

Jodee A. Kozlak(1) |  |  | ||||||||||||

Henry J. Maier(1) |  |  | ||||||||||||

James B. Stake(1) |  | |||||||||||||

Paula C. Tolliver(1) |  |  | ||||||||||||

Henry W. “Jay” Winship(1) |  |  | ||||||||||||

(1)Director is indicated as independent. |  | Member |  | Chair | ||||||||||

| 30 |  | ||||

Audit Committee 2022 Meetings: 7 Report: See page 81 |  James B. Stake, Chair | Other Members: àJames J. Barber, Jr. àTimothy C. Gokey àMark A. Goodburn àPaula C. Tolliver | ||||||||||||||||||

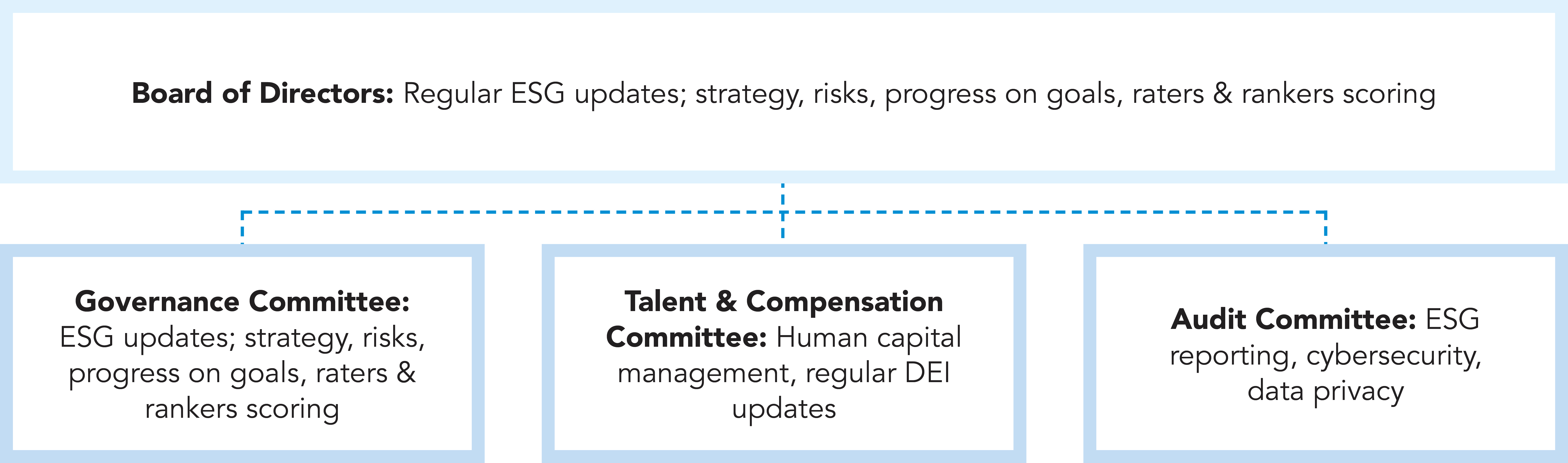

| Function: The Audit Committee assists the Board in fulfilling its oversight responsibilities relating to the quality and integrity of the financial reports of the company. The Audit Committee has the sole authority to appoint, review, and discharge our independent auditors, and has established procedures for the receipt, retention, and response to complaints regarding accounting, internal controls, or audit matters. | ||||||||||||||||||||

Key Responsibilities: Among other responsibilities in the Audit Committee Charter, the Audit Committee is responsible for: 1.Reviewing the scope, timing, and costs of the audit with the company’s independent registered public accounting firm and reviewing the results of the annual audit; 2.Assessing the independence of the outside auditors on an annual basis, including receipt and review of a written report from the independent auditors regarding their independence consistent with applicable rules of the Public Company Accounting Oversight Board; 3.Reviewing and approving in advance the services provided by the independent auditors; 4.Overseeing the internal audit function; 5.Reviewing the company’s significant accounting policies, financial results, and earnings releases and the adequacy of our internal controls and procedures; 6.Reviewing the risk management status of the company, including cybersecurity risks; and 7.Reviewing and approving related-party transactions. | ||||||||||||||||||||

Independence and Financial Expertise: All of our Audit Committee members are “independent” under applicable Nasdaq listing standards and Securities and Exchange Commission rules and regulations. James J. Barber, Jr. was appointed to the Audit Committee on January 1, 2023. The Board has determined that all five members of the Audit Committee, Messrs. Barber, Gokey, Goodburn, and Stake, and Ms. Tolliver, meet the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. | ||||||||||||||||||||

| 2023 Proxy Statement | 31 | ||||

Talent & Compensation Committee 2022 Meetings: 5 |  Jodee A. Kozlak, Chair | Other Members: àKermit R. Crawford àTimothy C. Gokey àMary J. Steele Guilfoile àHenry W. “Jay” Winship | ||||||||||||||||||

| Function: The Talent & Compensation Committee has oversight responsibilities relating to overall talent strategy, executive compensation, employee compensation and benefits programs and plans, succession and leadership development, and diversity, equity & inclusion. | ||||||||||||||||||||

Key Responsibilities: Among other responsibilities in the Talent & Compensation Committee Charter, the Talent & Compensation Committee is responsible for: 1.Reviewing the performance of the Chief Executive Officer; 2.Determining all elements of the compensation and benefits for the Chief Executive Officer and other executive officers of the company; 3.Reviewing and approving the company’s compensation program, including equity-based plans, for management employees generally; 4.Reviewing the company’s policies, practices, performance, disclosures, and progress toward goals with respect to significant issues of DEI and Human Capital Management, including the alignment of such efforts with the Company’s overall strategy; 5.Overseeing the company’s process of conducting advisory shareholder votes on executive compensation; and 6.Reviewing executive officers’ employment agreements; separation and severance agreements; change in control agreements; and other compensatory contracts, arrangements, and benefits. | ||||||||||||||||||||

Independence: All of our Talent & Compensation Committee members are “independent” under applicable Nasdaq listing standards and Internal Revenue Service and Securities and Exchange Commission rules and regulations. | ||||||||||||||||||||

| 32 |  | ||||

Governance Committee 2022 Meetings: 4 |  Kermit R. Crawford, Chair | Other Members: àMary J. Steele Guilfoile àJodee A. Kozlak àHenry J. Maier | ||||||||||||||||||

| Function: The Governance Committee identifies for the Board individuals qualified to become Board members, considers nominees recommended by shareholders, and recommends nominees to the Board for election as directors. The Committee also adopts and revises corporate governance guidelines applicable to the Company and serves in an advisory capacity to the Board on matters of organization and the conduct of Board activities. | ||||||||||||||||||||

Key Responsibilities: Among other responsibilities in the Governance Committee Charter, the Governance Committee is responsible for: 1.Periodically reviewing and making recommendations to the Board as to the size, diversity, and composition of the Board and criteria for director nominees; 2.Identifying and recommending candidates for service on the Board; 3.Reviewing and revising the company’s Corporate Governance Guidelines, including recommending any necessary changes to the Corporate Governance Guidelines to the Board; 4.Leading the Board in an annual review of the performance of the Board and the Board committees; 5.Making recommendations to the Board regarding Board committee assignments; 6.Making recommendations to the Board on whether each director is independent under all applicable requirements; 7.Making recommendations to the Board with respect to the compensation of non-employee directors; 8.Periodically reviewing with the company’s Chief Legal Officer developments that may have a material impact on the company’s corporate governance programs, including related compliance policies; and 9.Reviewing, at least annually, the company’s policies, practices, performance, disclosures, and progress toward goals with respect to significant issues of Environmental, Social, and Governance (“ESG”), including the alignment of such efforts with the company’s overall strategy. | ||||||||||||||||||||

Independence: All members of our Governance Committee are “independent” under applicable Nasdaq listing standards. | ||||||||||||||||||||

| 2023 Proxy Statement | 33 | ||||

Capital Allocation and Planning Committee 2022 Meetings: 12 |  Henry W. “Jay” Winship, Chair | Other Members: àScott P. Anderson àMark A. Goodburn àHenry J. Maier àPaula C. Tolliver | ||||||||||||||||||

| Function: The Capital Allocation and Planning Committee objectively assesses value creation opportunities and supports and makes recommendations to the Board to assist in its and management’s review of, and planning for, the company’s capital allocation, operations and strategy, and enhanced transparency and disclosures to shareholders. | ||||||||||||||||||||

Key Responsibilities: Among other responsibilities, the Capital Allocation and Planning Committee is responsible for: 1.Reviewing and evaluating the company’s business and financial strategies and growth opportunities, including performance toward those strategies and opportunities and making recommendations to the Board in respect thereof; 2.Reviewing and making recommendations to the Board regarding the company’s capital allocation, cash flow, technology initiatives, capital expenditures, and financing requirements; 3.Reviewing and making recommendations to the Board regarding potential material mergers, acquisitions, divestitures, and other key strategic transactions; and 4.Reviewing and evaluating the company’s annual operating and capital plans and budgets and making recommendations to the Board based on its findings. | ||||||||||||||||||||

Independence: While the Capital Allocation and Planning Committee is not subject to particular Nasdaq independence requirements, a majority of the members of our Capital Allocation and Planning Committee are “independent” under applicable Nasdaq listing standards. | ||||||||||||||||||||

| 34 |  | ||||

àQuarterly and fiscal year financial results àEnvironmental, Social, and Governance àLong range financial planning and review of financial models àLong-term strategic planning and M&A àRisk management, mitigation, and insurance updates àReview and revision, as necessary, of policies and committee charters | àCybersecurity, Privacy, and Compliance àHuman Capital Management and DEI àLeadership succession and Talent planning àExecutive compensation àDirector compensation àBoard composition, effectiveness, and self-assessment results | |||||||||||||||||||||||||||||||

BOARD RESPONSIBILITIES àThe Board is actively involved in the oversight of risks that could affect the company. | ||

AUDIT COMMITTEE àRisk oversight is conducted primarily through the Audit Committee. àThe Audit Committee Charter provides that the Audit Committee is responsible for at least annually reviewing the company’s key risks or exposures and assessing the steps management has taken to minimize such risk. àProvides periodic risk assessment updates to the Board and solicits input from the Board regarding the company’s risk management practices. | TALENT & COMPENSATION COMMITTEE àPeriodically reviews the company’s compensation programs to ensure that they do not encourage excessive risk-taking. | ||||

MANAGEMENT RESPONSIBILITIES àManagement is responsible for our Enterprise Risk Management (“ERM”) program, which includes key risk identification, mitigation efforts, day-to-day management, and communication to the Audit Committee. | ||

| 2023 Proxy Statement | 35 | ||||

| OVERSIGHT OF ESG | ||||

| CLIMATE | ||||

| OVERSIGHT OF ENTERPRISE RISK MANAGEMENT | ||||

| 36 |  | ||||

| OVERSIGHT OF CYBERSECURITY | ||||

| OVERSIGHT OF DATA PRIVACY | ||||

| OVERSIGHT OF TALENT & CULTURE | ||||

| 2023 Proxy Statement | 37 | ||||

| 38 |  | ||||

| 2023 Proxy Statement | 39 | ||||

| Compensation Element | Compensation Amount ($) | ||||||||||||||||

| Non-Employee Director Compensation: | |||||||||||||||||

| Annual Cash Retainer | $110,000 | ||||||||||||||||

| Annual Equity Award (RSUs) | 175,000 | ||||||||||||||||

| Independent Chair of the Board Additional Cash Retainer | 100,000 | ||||||||||||||||

| Committee Service Compensation: | Chair | Member | |||||||||||||||

| Audit Committee | $30,000 | $12,500 | |||||||||||||||

| Talent & Compensation Committee | 20,000 | 7,500 | |||||||||||||||

| Governance Committee | 20,000 | 7,500 | |||||||||||||||

Capital Allocation and Planning Committee(1) | 20,000 | 7,500 | |||||||||||||||

| ||||||||

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Total | Aggregate Number of Shares Outstanding as of December 31, 2019(2) | ||||||||||||||||

| Scott P. Anderson | $ | 138,562 | (3) | $ | 150,000 | $ | 288,562 | 18,528 | ||||||||||||

| Wayne M. Fortun | 117,500 | 150,000 | 267,500 | 39,945 | ||||||||||||||||

| Timothy C. Gokey | 110,000 | (4) | 150,000 | 260,000 | 6,493 | |||||||||||||||

| Mary J. Steele Guilfoile | 105,000 | 150,000 | 255,000 | 13,342 | ||||||||||||||||

| Jodee A. Kozlak | 105,000 | 150,000 | 255,000 | 14,269 | ||||||||||||||||

| Brian P. Short | 110,000 | (4) | 150,000 | 260,000 | 60,276 | |||||||||||||||

| James B. Stake | 127,500 | (5) | 150,000 | 277,500 | 21,465 | |||||||||||||||

| Paula C. Tolliver | 110,000 | (4) | 150,000 | 260,000 | 3,781 | |||||||||||||||

| 40 |  | ||||

Name(1) | Fees Earned or Paid in Cash | Stock Awards(2) | Total | Aggregate Number of Shares Subject to Stock Awards Outstanding as of December 31, 2022(3) | ||||||||||||||||||||||

| Scott P. Anderson | $242,500 | $140,000 | $382,500 | 23,672 | ||||||||||||||||||||||

James J. Barber, Jr.(4) | 4,730 | 6,087 | 10,870 | 83 | ||||||||||||||||||||||

| Kermit R. Crawford | 125,000 | 140,000 | 265,000 | 3,738 | ||||||||||||||||||||||

Wayne M. Fortun(5) | 42,886 | 48,032 | 90,918 | 19,229 | ||||||||||||||||||||||

| Timothy C. Gokey | 130,000 | (6) | 140,000 | 270,000 | 15,595 | |||||||||||||||||||||

Mark A. Goodburn(7) | 79,828 | (6) | 91,223 | 171,051 | 2,028 | |||||||||||||||||||||

| Mary J. Steele Guilfoile | 125,000 | 140,000 | 265,000 | 15,388 | ||||||||||||||||||||||

| Jodee A. Kozlak | 137,500 | 140,000 | 277,500 | 19,413 | ||||||||||||||||||||||

Henry J. Maier(8) | 98,243 | 117,056 | 215,299 | 1,501 | ||||||||||||||||||||||

Brian P. Short(5) | 44,601 | (6) | 48,032 | 92,633 | 45,612 | |||||||||||||||||||||

| James B. Stake | 147,500 | 140,000 | 287,500 | 26,957 | ||||||||||||||||||||||

| Paula C. Tolliver | 130,000 | 140,000 | 270,000 | 10,211 | ||||||||||||||||||||||

Henry W. “Jay” Winship(8) | 98,243 | 117,056 | 215,299 | 1,501 | ||||||||||||||||||||||

| 2023 Proxy Statement | 41 | ||||

| ||||||||

Proposal 2: Advisory Vote on the Compensation of Named Executive Officers (“Say-on-Pay”) C.H. Robinson is providing its shareholders the opportunity to cast a non-binding advisory vote on the compensation of its named executive officers (“NEOs”), as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion in this Proxy Statement. At the Annual Meeting, shareholders will vote on the following advisory resolution regarding the compensation of NEOs as described in this Proxy Statement: “RESOLVED, that the shareholders of C.H. Robinson Worldwide, Inc. approve, on an advisory basis, the compensation paid to the company’s named executive officers as disclosed in the ‘Compensation Discussion and Analysis’ section, and compensation tables and narrative discussion contained in the ‘Executive Compensation’ section in this Proxy Statement.” C.H. Robinson, with guidance and oversight from our Talent & Compensation Committee, has adopted an executive compensation philosophy that is intended to be consistent with our overall compensation approach and to achieve the following goals: 1.Pay incentive compensation aligned with company earnings performance; 2.Encourage executives to make long-term career commitments to C.H. Robinson and align executives’ interests with those of our shareholders; 3.Balance incentive compensation to achieve both annual and long-term profitability and growth; 4.Emphasize supporting both team and company goals, business transformation, and company culture; and 5.Provide a level of total compensation necessary to attract, retain, and motivate high quality executives. We believe that our executive compensation program is aligned with the long-term interests of our shareholders. In considering this proposal, we encourage you to review the 2022 Compensation Discussion and Analysis section of this Proxy Statement and related compensation tables and narrative discussion beginning on page 43. It provides detailed information on our executive compensation, including our compensation philosophy and objectives and the 2022 compensation of our NEOs. C.H. Robinson has requested shareholder approval of the compensation of our NEOs on an annual basis. Our compensation disclosures, including our Compensation Discussion and Analysis, compensation tables, and discussion in this Proxy Statement, are done in accordance with the Securities and Exchange Commission’s compensation disclosure rules. àAs an advisory vote, this Proposal 2 is non-binding. However, the Board of Directors and the Talent & Compensation Committee value the opinions of our shareholders and will consider the results of the vote when making future compensation decisions for our NEOs. | ||||||||

BOARD VOTING RECOMMENDATION The Board of Directors recommends a vote FOR the advisory approval of the compensation of named executive officers. | ||||||||

| ||||||||

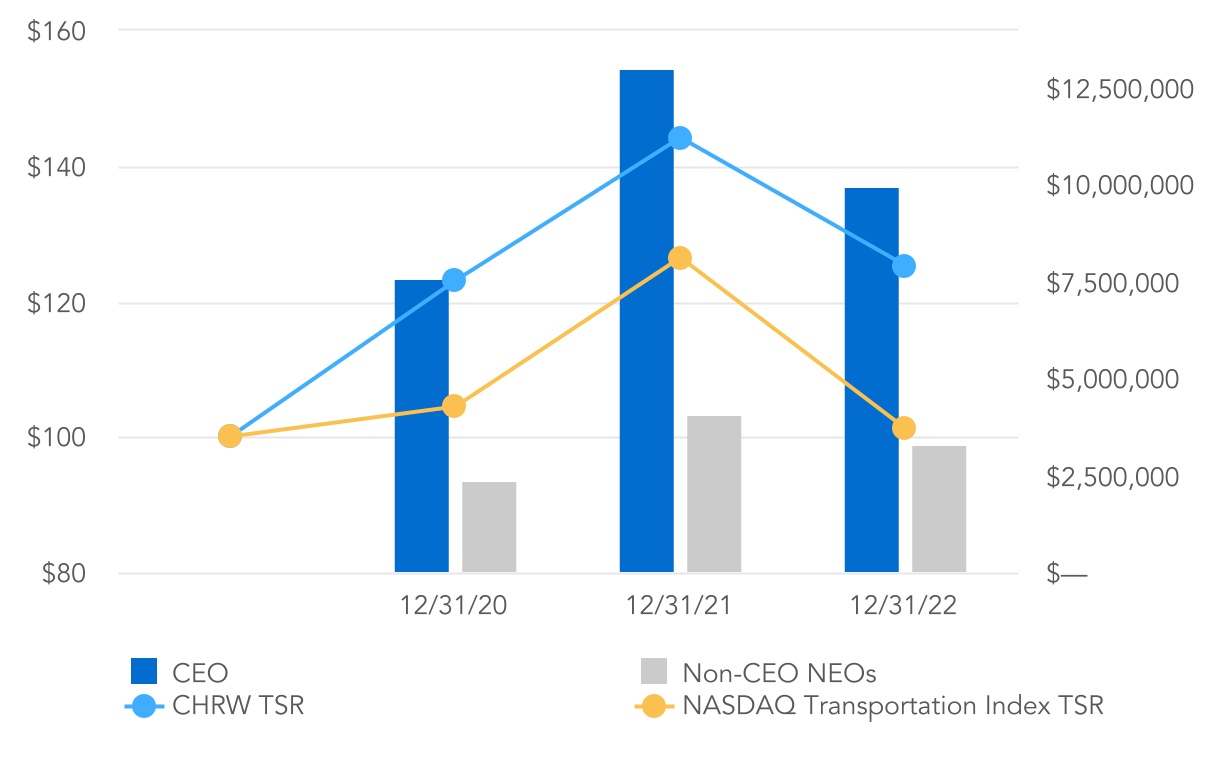

2022 COMPENSATION DISCUSSION AND ANALYSIS The following Compensation Discussion & Analysis (“CD&A”) describes the background, objectives, and | |||||||||||

àMichael P. Zechmeister, Chief Financial Officer àArun D. Rajan, Chief Operating Officer(2) àMac S. Pinkerton, President of àMichael J. Short, President of Global Forwarding | |||||||||||

| ||||||||

| ||||||||

| ||||||||

| 2023 Proxy Statement | 43 | ||||

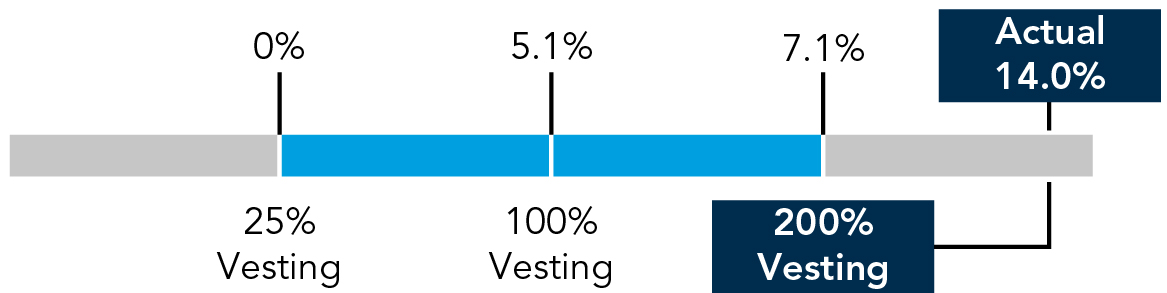

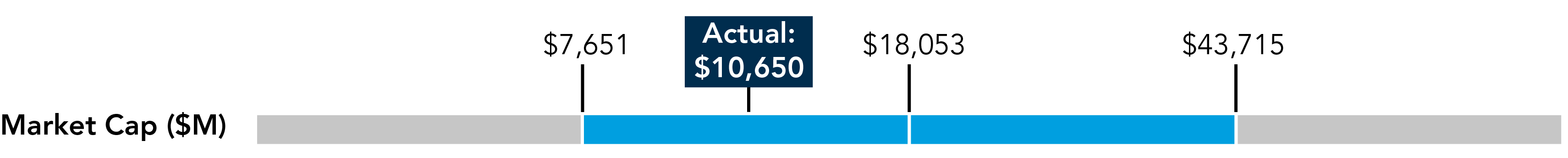

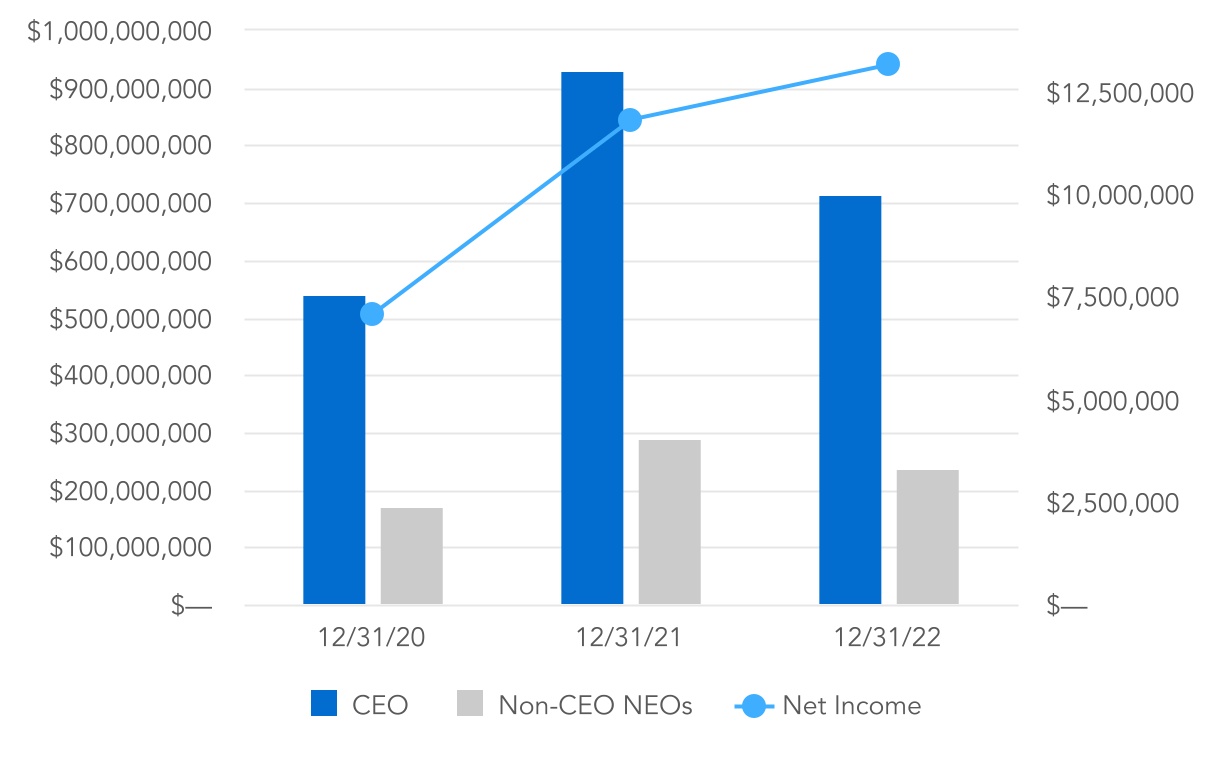

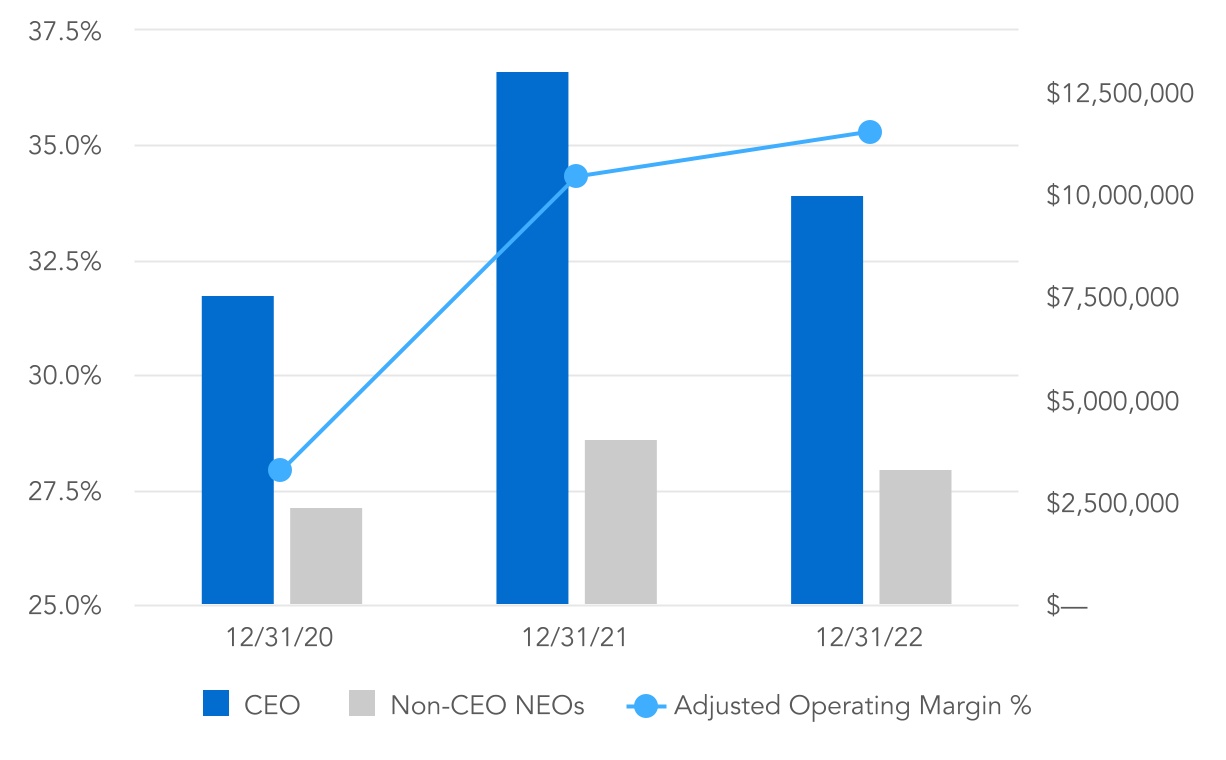

Total revenues increased 6.9% to $24.7 billion, driven by higher pricing in nearly all of our service lines, most notably truckload, LTL, and ocean services. | 2.3 billion digital transactions with customers and carriers in 2022, a 30% year-over-year increase. | Income from operations totaled $1.3 billion, up 17.1% from last year primarily due to the increase in AGP, partially offset by the increase in operating expenses. | Adjusted gross profits(1) (“AGP”) increased 14.0% to $3.6 billion, driven by higher adjusted gross profit per transaction in truckload and LTL services. | ||||||||||||||||||||||||||

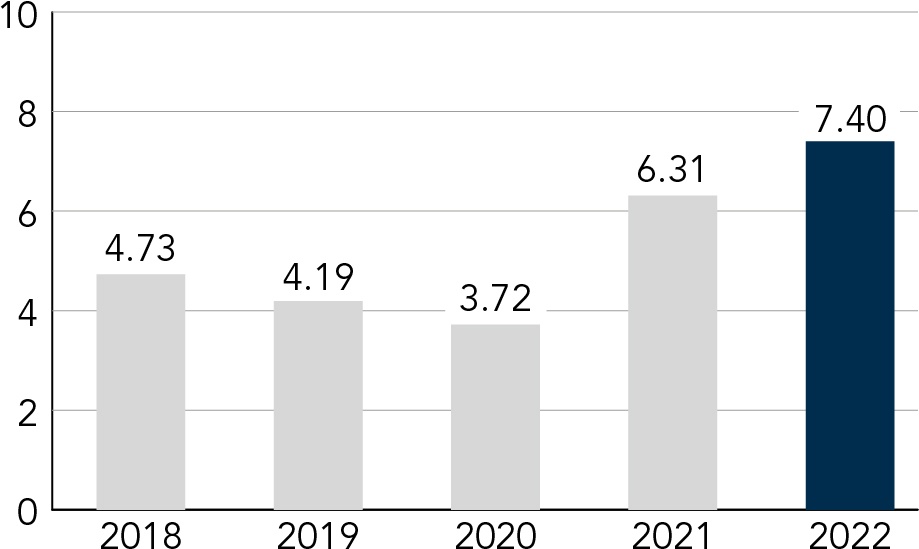

Increased our regular quarterly dividend 10.9% from $0.55 per share to $0.61 per share. | Cash returned to shareholders increased 100.2% to $1.8 billion. | Diluted earnings per share (EPS) increased 11.4% to $7.40. | |||||||||||||||||||||||||||

| 44 |  | ||||

| Element | Key Features | Result | |||||||||

| 2022 Annual Incentive Cash Plan | Based on adjusted pre-tax income (APTI) and, for NEOs other than CEO, MBOs, including one specific to DEI. | Above Target | h | ||||||||

Performance-Based Equity Awards(1) | Aligned to Diluted EPS Growth | At Target | n | ||||||||

Adjusted Gross Profit PSUs(2) | Aligned to AGP Growth | Above Target | h | ||||||||

| 2023 Proxy Statement | 45 | ||||

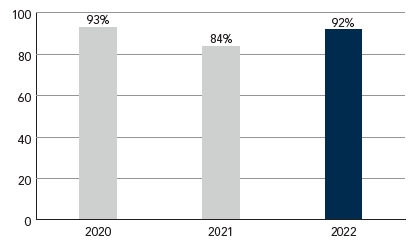

| 92% Voted in Favor of our Executive Compensation Program at our 2022 Annual Meeting of Shareholders | ||||

| 46 |  | ||||

| WHAT WE HEARD... | HOW WE RESPONDED... | ||||||||||

àConsider, on a going-forward basis, having the treatment of equity awards that are assumed or converted following a change in control be double trigger | àEffective January 1, 2023, C.H. Robinson has expanded its double trigger for all equity awards, including performance-based awards | ||||||||||

àEnhance disclosure regarding holding requirements | àC.H. Robinson has enhanced our disclosure to our ownership guidelines and we have included the policy in this Proxy Statement | ||||||||||

àConsider disclosing a peer group that can be used to make executive compensation decisions | àC.H. Robinson has selected and adopted a formal peer group for purposes of executive compensation | ||||||||||

àConsider the metrics in the annual incentive plan | àIn 2023, C.H. Robinson introduced a new Annual Incentive Plan, which consists of blended volume growth, operating income margin and MBO/SBO scorecards | ||||||||||

àConsider the performance period for the long term incentive plan | àIn 2023, C.H. Robinson introduced new performance stock unit (PSU) awards where 33.33% is measured on diluted earnings per share (EPS), 33.33% on adjusted gross profit (AGP), and 33.34% on average adjusted operating income margin; each of these measures has a cumulative 3-year performance period | ||||||||||

àConsider removing the counting of vested stock options and unvested performance shares in the stock ownership guidelines | àIn 2023, C.H. Robinson removed the counting of vested stock options and unvested performance shares for stock ownership guidelines | ||||||||||

| 2023 Proxy Statement | 47 | ||||

WHAT WE DO àWe Do require approval of our executive compensation and incentive payouts àWe Do target pay opportunity that is generally aligned to the | |||||||||||

àWe Do have the majority of pay at risk and performance-based àWe Do have the majority of annual incentive compensation performance metrics directly tied to a key driver of shareholder value (APTI) àWe Do have appropriate caps on incentive plan payouts; two times target opportunity àWe Do have double trigger change of control provisions in time-based equity awards made after January 1, 2022, and performance stock unit awards made after January 1, 2023 àWe Do have long-term incentives that are performance-based to create alignment with shareholders àWe Do have long-term incentive plan performance metrics that reward management for scaling the business and creating profitable market share growth àWe Do have robust stock ownership guidelines and a minimum of a 1-year deferred delivery requirement for shares earned under equity awards àWe Do have a clawback policy àWe Do have our equity compensation subject to forfeiture and clawback if executive violates restrictive covenants àWe Do have an Executive Separation and Change in Control Plan àWe Do have a Talent & Compensation Committee comprised entirely of independent directors àWe Do have our Talent & Compensation Committee engage with an independent consultant àWe Do have our Talent & Compensation Committee regularly meet in executive session without management present | WHAT WE DON’T DO àWe Don’t have guaranteed bonuses àWe Don’t have supplemental pension or executive retirement plan (SERP) benefits | ||||||||||

àWe Don’t allow repricing of underwater options or stock appreciation rights without shareholder approval | |||||||||||

àWe Don’t allow hedging or pledging of company shares | |||||||||||

àWe Don’t allow discounted | |||||||||||

àWe Don’t allow transactions in company stock by our officers or directors without pre-clearance àWe Don’t pay dividends on unvested performance stock units and restricted stock | |||||||||||

| ||||||||

| NEO | Title | 2018 Base Salary | 2019 Base Salary | % Change | ||||||||||

| Robert C. Biesterfeld Jr. | President and Chief Executive Officer | $ | 700,000 | $ | 975,000 | 39 | % | |||||||

| John P. Wiehoff | Former President and Chief Executive Officer | 1,167,000 | 1,200,000 | 3 | % | |||||||||

| Andrew C. Clarke | Former Chief Financial Officer | 550,000 | 550,000 | 0 | % | |||||||||

Scott S. Hagen(1) | Former Interim Chief Financial Officer | N/A | 230,000 | N/A | ||||||||||

Michael P. Zechmeister(2) | Chief Financial Officer | N/A | 700,000 | N/A | ||||||||||

| Christopher J. O’Brien | Chief Commercial Officer | 500,000 | 500,000 | 0 | % | |||||||||

Mac S. Pinkerton(3) | President of NAST | N/A | 475,000 | N/A | ||||||||||

| Michael J. Short | President of Global Forwarding Freight | 500,000 | 525,000 | 5 | % | |||||||||

| ||||||||

| 2019 NEO Annual Incentive Compensation Metrics | Target | Actual | ||||||

Enterprise APTI growth(1) | 7% | -16% | ||||||

North America Surface Transportation APTI growth(2) | 7% | -12% | ||||||

Global Forwarding APTI growth(3) | 10% | -11% | ||||||

| ||||||||

| Performance Vesting Year | 2014 Award | 2015 Award | 2016 Award | 2017 Award | 2018 Award | 2019 Award (1) | ||||||||||||||

| 2015 | 25% | — | — | — | — | — | ||||||||||||||

| 2016 | 12% | 12% | — | — | — | — | ||||||||||||||

| 2017 | 9% | 9% | 9% | — | — | — | ||||||||||||||

| 2018 | 43% | 43% | 43% | 43% | — | — | ||||||||||||||

| 2019 | 0% | 0% | 0% | 0% | 0% | — | ||||||||||||||

| Total Cumulative Vesting | 89% | 64% | 52% | 43% | 0% | 0% | ||||||||||||||

| Vesting Years Remaining | 0 | 1 | 2 | 3 | 4 | 5 | ||||||||||||||

| Vesting Year | 2014 Award | 2015 Award | 2016 Award | 2017 Award | 2018 Award | 2019 Award (1) | ||||||||||||||

| 2015 | 25% | — | — | — | — | — | ||||||||||||||

| 2016 | 12% | 20% | — | — | — | — | ||||||||||||||

| 2017 | 9% | 20% | 20% | — | — | — | ||||||||||||||

| 2018 | 43% | 20% | 20% | 20% | — | — | ||||||||||||||

| 2019 | 0% | 20% | 20% | 20% | 20% | — | ||||||||||||||

| Total Cumulative Vesting | 89% | 80% | 60% | 40% | 20% | 0% | ||||||||||||||

| Vesting Years Remaining | 0 | 1 | 2 | 3 | 4 | 5 | ||||||||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| 2023 Proxy Statement | 49 | ||||

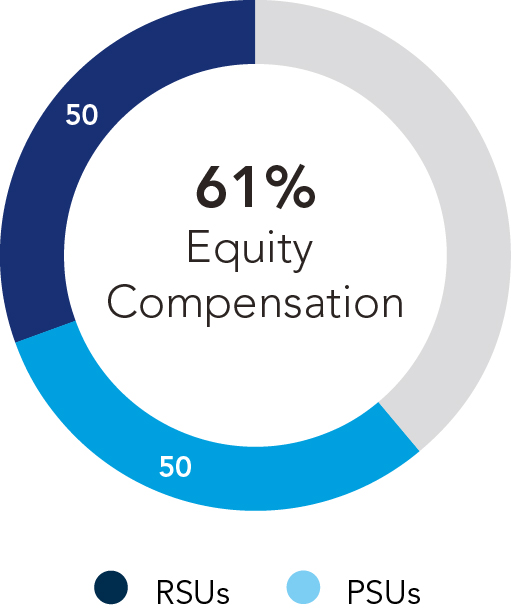

CEO 2022 Target Compensation(1) | Average Other NEO 2022 Target Compensation | ||||

|  | ||||

| 50 |  | ||||

| Element | Performance Period | Objective | Performance Measured/Rewarded | ||||||||

| Base Salary | Annual | Attracts, retains, and rewards top talent and reflects each NEO’s responsibilities, performance, leadership potential, succession planning, and relevant market data. | Provides NEOs with fixed compensation that serves as a vehicle to attract and retain. Rewards executives for key performance and contributions. Generally, we target the 50th percentile of our defined market for talent. | ||||||||

| Annual Cash Incentive | Annual | Motivates and rewards our executives for the achievement of financial performance and certain strategic goals for the company. | In 2022, the annual cash incentive was based on the following: •CEO - Target opportunity was 155% of base salary and was based on enterprise adjusted pre-tax income (“APTI”). APTI is a non-GAAP financial measure calculated as income before provision for income taxes adjusted for executive short-term incentives and other unusual items including acquisitions. •Operating Executive Officers - Target opportunity varied from 55% to 85% of base salary and was based on the APTI of the business division and/or region of responsibility for the executive, enterprise APTI, and management business objectives (“MBOs”), one specific to DEI. •Shared Services Officers - Target opportunity varied from 75% to 100% of base salary and was based on enterprise APTI and MBOs, one specific to DEI. •For all executive officers the maximum annual incentive that may be paid is two times the planned annual incentive at target. •Threshold and maximum performance goals for NEOs were set at 70% and 120% of the relevant APTI targets, respectively. | ||||||||

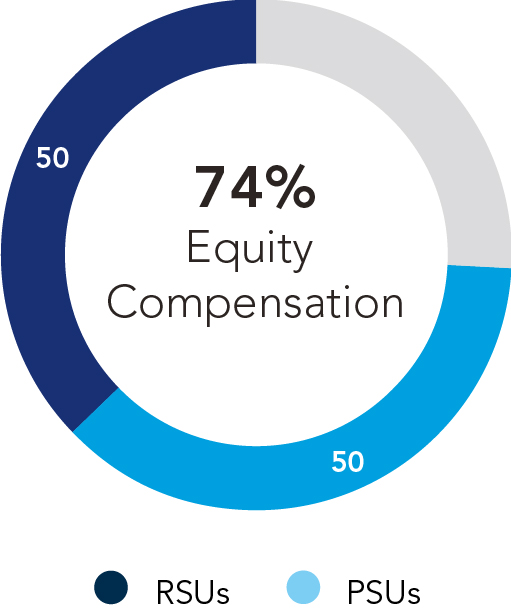

| Performance Stock Units (PSUs) | Long-Term | Aligns the interests of management and shareholders. | •Accounts for 50% of NEOs’ equity grant value. •75% of PSUs are aligned to Diluted Earnings Per Share (“EPS”), which aligns to business strategy for long-term performance, across varying market cycles and longer-term secular changes. EPS awards vest based on a cumulative 3-year measure. •25% of PSUs are aligned to budgeted adjusted gross profit, which aligns to our commitment to our customers and rewards management for profitable growth for each of three successive 1-year periods. •Both measures under the PSU plan have a vesting period of 3 years and a 1-year delayed distribution of shares. •To reward for driving high levels of performance, participants may earn up to two times the number of shares granted. | ||||||||

| Restricted Stock Units (RSUs) | Long-Term | Aligns the interests of management and shareholders. Supports our desire to retain our critical talent to drive our long-term business transformation. | •Accounts for 50% of NEOs’ equity grant value. •RSUs have a vesting period of 3 years and a 1-year delayed distribution of shares. | ||||||||

| 2023 Proxy Statement | 51 | ||||

Annual Base Salary(1) | Target Incentive as % of Base Salary(1) | Maximum Incentive as % of Base Salary(1) | Target Enterprise APTI Growth % | Actual Enterprise APTI Growth % | ||||||||||

| $700,000 | 100 | % | 200 | % | 7 | % | -16 | % | ||||||

| $975,000 | 120 | % | 240 | % | 7 | % | -16 | % | ||||||

| Annual Cash Incentive Compensation | ADJUSTED PRE-TAX INCOME (APTI) NEO annual incentive compensation amounts are set as a percentage of their base salary, to reflect the executive’s responsibilities, performance, and contribution to overall company goals. The measure used to determine the financial component of annual incentive compensation is APTI. APTI is a non-GAAP financial measure calculated as income before provision for income taxes adjusted for executive short-term incentives and other unusual items including acquisitions. See below for a reconciliation of APTI to income before provision for income taxes. We believe growth in APTI is the appropriate measure for our annual cash incentive compensation because it rewards profitable growth, which is aligned with the interests of our shareholders. Each year, the Talent & Compensation Committee establishes target APTI growth for the enterprise and the divisions at levels that are consistent with the company’s long-term expected results. Given the transactional nature of a significant portion of our business and our fluctuating adjusted gross profit margins due to market conditions, historically the company has found it difficult to forecast short-term performance. As such, we believe it is important to align targets more closely with our long-term growth goals, with some consideration given to shorter-term market trends and divisional business plans. MANAGEMENT BUSINESS OBJECTIVES (MBOS) The Talent & Compensation Committee included MBOs as part of our 2022 annual cash incentive compensation plan for each NEO, other than Mr. Biesterfeld, to incentivize the achievement of more individualized financial and operational objectives that are critical to our long-term strategy as well as our commitment to DEI. The MBOs were designed to recognize the initiatives that help the company navigate the large cyclical swings that affect the freight transportation environment, as well as our initiatives to continue driving operating margin expansion over the long-term, achieve overall market-share growth, and the successful implementation of our digital transformation efforts. The DEI MBO directly supports the company’s DEI goals and serves to hold leaders accountable for advancing the company’s DEI strategy. | ||||

| Equity Compensation | DILUTED EARNINGS PER SHARE (EPS) AND ADJUSTED GROSS PROFIT (AGP) Equity compensation is a critical part of how we incentivize and reward our leadership for enterprise performance. As our strategy in the organization evolves to meet the changing needs of our marketplace, we adopted a new equity plan, which included changes to our equity plan to align with that strategy. In designing the changes to our equity plan and awards, we had several key objectives: to support our business transformation and our strong, performance-oriented culture, to ensure we are market competitive in order to attract and retain top talent, to have high perceived value amongst participants, and, of course, to be aligned with our shareholders’ interests. Our equity compensation philosophy is to pay for performance and reward profitable long-term growth. The metrics we use in our plan reward management for scaling the business and creating profitable market share growth. More specifically, EPS aligns to our business strategy for long-term performance, across varying market cycles and longer-term secular changes, and AGP aligns to our commitment to our customers and rewards management for profitable growth. | ||||

| ||||||||

| NEO | Title | 2021 Base Salary | 2022 Base Salary | % Change | ||||||||||||||||

| Robert C. Biesterfeld Jr. | Former President and Chief Executive Officer | $1,075,000 | $1,100,000 | 2 | % | |||||||||||||||

| Michael P. Zechmeister | Chief Financial Officer | 725,000 | 740,000 | 2 | % | |||||||||||||||

Arun D. Rajan(1) | Chief Operating Officer | 800,000 | 840,000 | 5 | % | |||||||||||||||

| Mac S. Pinkerton | President of NAST | 610,000 | 625,000 | 2 | % | |||||||||||||||

Michael J. Short(2) | President of Global Forwarding | 550,000 | 625,000 | 14 | % | |||||||||||||||

| Base Salary Paid | Cash Incentive Compensation | Total Cash | % of Target Incentive Achieved(1) | Equity Earned(2) | Total Realized Compensation | |||||||||||||||

| 2019 | $ | 870,833 | $ | 428,895 | $ | 1,299,728 | 42 | % | $ | 827,858 | $ | 2,127,586 | ||||||||

| 2018 | 600,000 | 849,620 | 1,449,620 | 136 | % | 1,217,312 | 2,666,932 | |||||||||||||

| 2017 | 475,000 | 245,848 | 720,848 | 65 | % | 281,602 | 1,002,450 | |||||||||||||

| Base Salary Paid | Cash Incentive Compensation | Total Cash | % of Target Incentive Achieved(1) | Equity Earned(2) | Total Realized Compensation | |||||||||||||||

| 2019 | $ | 757,000 | $ | — | $ | 757,000 | N/A | $ | 1,709,048 | $ | 2,466,048 | |||||||||

| 2018 | 1,167,000 | 2,427,366 | 3,594,366 | 166 | % | 6,491,123 | 10,085,489 | |||||||||||||

| 2017 | 1,167,000 | 871,475 | 2,038,475 | 60 | % | 1,752,027 | 3,790,502 | |||||||||||||

| NEO | Target Incentive as % of Base Salary | $ Target Incentive | % Tied to Enterprise APTI | % Tied to NAST APTI | % Tied to Global Forwarding APTI | % Tied to MBO | |||||||||||||||||

| Robert C. Biesterfeld Jr. | 155 | % | $1,705,000 | 100 | % | 0 | % | 0 | % | 0 | % | ||||||||||||

| Michael P. Zechmeister | 85 | % | 629,000 | 80 | % | 0 | % | 0 | % | 20 | % | ||||||||||||

| Arun D. Rajan | 100 | % | 840,000 | 80 | % | 0 | % | 0 | % | 20 | % | ||||||||||||

| Mac S. Pinkerton | 85 | % | 531,250 | 30 | % | 50 | % | 0 | % | 20 | % | ||||||||||||

| Michael J. Short | 85 | % | 531,250 | 30 | % | 0 | % | 50 | % | 20 | % | ||||||||||||

| 2023 Proxy Statement | 53 | ||||

| Threshold | Target | Maximum | ||||||||||||||||||

| Enterprise APTI |   | |||||||||||||||||||

| Base Salary Paid | Cash Incentive Compensation | Total Cash | % of Target Incentive Achieved(1) | Equity Earned(2) | Total Realized Compensation | |||||||||||||||

| 2019 | $ | 137,500 | $ | — | $ | 137,500 | N/A | $ | 325,382 | $ | 462,882 | |||||||||

| 2018 | 550,000 | 640,642 | 1,190,642 | 166 | % | 1,123,790 | 2,314,432 | |||||||||||||

| 2017 | 550,000 | 230,004 | 780,004 | 60 | % | 292,080 | 1,072,084 | |||||||||||||

| Base Salary Paid | Cash Incentive Compensation | Total Cash | % of Target Incentive Achieved(1) | Equity Earned(2) | Total Realized Compensation | |||||||||||||||

| 2019 | $ | 330,000 | $ | 89,143 | $ | 419,143 | N/A | $ | 54,303 | $ | 473,446 | |||||||||

| Global Forwarding APTI |  | ||||||||||||||||

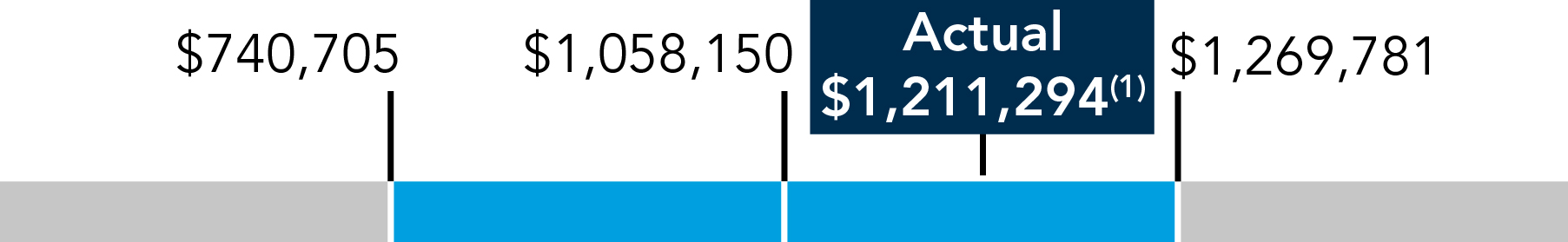

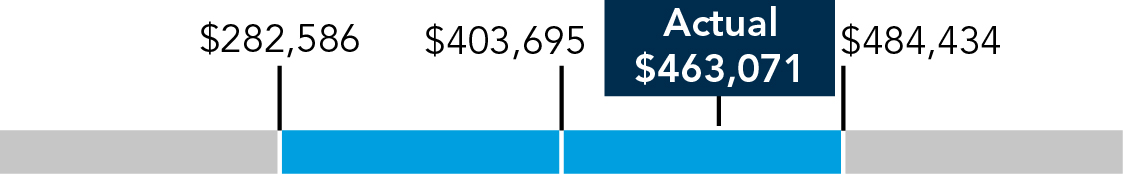

| Reconciliation of APTI to income before provision for income taxes ($ in 000’s) | Enterprise | NAST | Global Forwarding | ||||||||||||||

| APTI | $1,211,294 | $784,340 | $463,071 | ||||||||||||||

| Less: Executive bonuses | (7,846) | (912) | (840) | ||||||||||||||

Less: Impact of unusual or extraordinary items(1) | (36,684) | (9,499) | (7,005) | ||||||||||||||

| Income before provision for income taxes | $1,166,765 | $773,929 | $455,227 | ||||||||||||||

| ||||||||

| Annual Base Salary | Target Incentive as % of Base Salary | Maximum Incentive as % of Base Salary | Target Enterprise APTI Growth % | Actual Enterprise APTI Growth % | ||||||||||

| $700,000 | 85 | % | 170 | % | 7 | % | -16 | % | ||||||

| Base Salary Paid | Cash Incentive Compensation(1) | Total Cash | % of Target Incentive Achieved(2) | Equity Earned(3) | Total Realized Compensation | |||||||||||||||

| 2019 | $ | 235,985 | $ | 283,945 | $ | 519,930 | 42 | % | $ | 145,266 | $ | 665,196 | ||||||||

Michael P. Zechmeister,Chief Financial Officer | ||

•MBO Achievement %: 100% •DEI: Year over year Finance team progress toward the company’s 2025 DEI goals, which include leadership representation, engagement, hiring, and retention. Demonstrated leadership contributions and action steps to support and advance the company’s strategy to become more a diverse and inclusive organization. •Lead the delivery of a company strategic initiative to strengthen enterprise investment prioritization and resource alignment. | ||

Arun D. Rajan,Chief Operating Officer | ||

•MBO Achievement %: 105% •DEI: Demonstrated leadership contributions and action steps to support and advance the company’s strategy to become more a diverse and inclusive organization. •Accelerate the pace of development and deployment of technology and product capabilities; design scalable solutions that position C.H. Robinson competitively with customers and carriers; and leverage data science and machine learning to drive scale in transactional components of the business while also enabling margin growth and differentiated, strategic services. | ||

Mac S. Pinkerton,President of North American Surface Transportation (“NAST”) | ||

•MBO Achievement %: 95% •DEI: Year over year NAST team progress toward the company’s 2025 DEI goals, which include leadership representation, engagement, hiring, and retention. Demonstrated leadership contributions and action steps to support and advance the company’s strategy to become more a diverse and inclusive organization. •Achieve NAST operating margin target of 40%. | ||

Michael J. Short,President of Global Forwarding | ||

•MBO Achievement %: 105% •DEI: Year over year Global Forwarding team progress toward the company’s 2025 DEI goals, which include leadership representation, engagement, hiring, and retention. Demonstrated leadership contributions and action steps to support and advance the company’s strategy to become more a diverse and inclusive organization. •Improve our customer experience index, delivery of technology enhancements to enable longer term goal of increased files per person, and improvement in billing timeliness. | ||

| 55 | ||||||||||

| Annual Base Salary | Target Incentive as % of Base Salary | Maximum Incentive as % of Base Salary | Target Enterprise APTI Growth % | Actual Enterprise APTI Growth % | ||||||||||

| $500,000 | 60 | % | 120 | % | 7 | % | -16 | % | ||||||

| Base Salary Paid | Cash Incentive Compensation | Total Cash | % of Target Incentive Achieved(1) | Equity Earned(2) | Total Realized Compensation | |||||||||||||||

| 2019 | $ | 500,000 | $ | 126,975 | $ | 626,975 | 42 | % | $ | 316,439 | $ | 943,414 | ||||||||

| 2018 | 500,000 | 499,201 | 999,201 | 166 | % | 1,283,716 | 2,282,917 | |||||||||||||

| 2017 | 500,000 | 179,224 | 679,224 | 60 | % | 351,189 | 1,030,413 | |||||||||||||

| NEO | Achievement Tied to Financial Metrics (weighted) % | Achievement Tied to MBOs (weighted) % | Total Incentive Achievement % of Target | $ Total Payout Amount | |||||||||||||

| Robert C. Biesterfeld Jr. | 172 | % | N/A | 172 | % | $2,938,801 | |||||||||||

| Michael P. Zechmeister | 172 | % | 100% | 158 | % | 993,134 | |||||||||||

| Arun D. Rajan | 172 | % | 105% | 159 | % | 1,334,684 | |||||||||||

| Mac S. Pinkerton | 190 | % | 95% | 172 | % | 906,892 | |||||||||||

| Michael J. Short | 173 | % | 105% | 159 | % | 847,235 | |||||||||||

| ||||||||

| Annual Base Salary | Target Incentive as % of Base Salary | Maximum Incentive as % of Base Salary | Target NAST APTI Growth % | Actual NAST APTI Growth % | ||||||||||

| $475,000 | 80 | % | 160 | % | 7 | % | -12 | % | ||||||

| Base Salary Paid | Cash Incentive Compensation | Total Cash | % of Target Incentive Achieved(1) | Equity Earned(2) | Total Realized Compensation | |||||||||||||||

| 2019 | $ | 475,000 | $ | 212,943 | $ | 687,943 | 56 | % | $ | 177,291 | $ | 865,234 | ||||||||

| % of Target Compensation | |||||

CEO(1) | Other NEOs | ||||

|  | ||||

| 50% | 50% | ||||||||||

RESTRICTED STOCK UNITS (RSUs) àTime-based à3-year ratable | PERFORMANCE STOCK UNITS (PSUs) àPerformance-based à75% of PSUs tied to 3-year cumulative EPS growth à25% of PSUs tied to annual adjusted gross profit growth | ||||||||||

| 2023 Proxy Statement | 57 | ||||

| ||

| Annual Base Salary | Target Incentive as % of Base Salary | Maximum Incentive as % of Base Salary | Target Global Forwarding APTI Growth % | Actual Global Forwarding APTI Growth % | ||||||||||

| $525,000 | 70 | % | 140 | % | 10 | % | -11 | % | ||||||

| Threshold | Target | Maximum | |||||||||

| Adjusted Gross Profit |  | ||||||||||